What's the philosophy behind the Morningstar Rating for stocks?

Morningstar has been analyzing investment strategies for nearly 20 years. We've become experts at separating styles that haven't worked from those that have. And we've also developed our own strategy for investing in stocks.

It's pretty simple. Buying a stock means becoming part owner in a business, which means that over the long run, stock prices are ultimately driven by corporate financial performance.

Therefore, stocks should be valued as pieces of a business--not as, in the words of Warren Buffett, "little wiggling things with charts attached." That's why we spend a great deal of time thinking about things such as competitive advantages, cash flows, and economic moats--all of which are crucial to valuing companies as businesses.

It's no surprise, then, that the Morningstar Rating for stocks takes a business-centered approach. The rating compares a stock's current price with our estimate of the stock's fair value. We base this estimate on the present value of the company's future cash flows. Not on stock-price momentum. Nor on investor sentiment. Nor on other nonfinancial factors.

How is the rating created?

Morningstar analysts estimate a company's future financial performance using a detailed discounted cash-flow model that factors in projections for the company's income statement, balance sheet, and cash-flow statement. The result is an analyst-driven estimate of the stock's fair value.

What determines whether a stock gets 1, 2, 3, 4, or 5 stars?

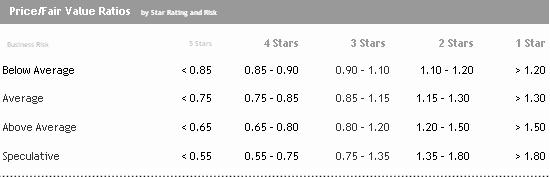

The Morningstar Rating for stocks system identifies stocks trading at a discount or premium to our estimate of their fair values. Generally speaking, stocks trading at large discounts to our analysts' fair value estimates will receive higher (4 or 5) star ratings, and stocks trading at large premiums to their fair value estimates will receive lower (1 or 2) star ratings. Stocks that are trading very close to our analysts' fair value estimates will receive 3-star ratings.

A stock's star rating is driven by its level of expected return. For example, 3-star stocks are those that should offer a "fair return," one that compensates for the riskiness of the stock. Five-star stocks, of course, should offer an investor a return that's well above the company's cost of equity, and high-risk 5-star stocks should offer a better expected return than low-risk 5-star stocks.

The riskier the stock, the greater the discount needed to earn 5 stars or premium needed to hit 1 star. The chart below shows the price/fair value ratios that correspond to each rating band.

What do you mean by "consider buying" and "consider selling"?

"Consider buying" is the price below which we think investors should consider purchasing a stock and is equivalent to the price at which it would earn a 5-star rating. "Consider selling" is the price above which we think investors should consider selling their shares and is equivalent to the price at which it would earn a 1-star rating. Be sure to take your individual circumstances--including diversification, risk tolerance, and tax considerations--into account before making a final decision to buy or sell shares.

How often do ratings change? What causes them to change?

Ratings are updated daily and can therefore change daily. They can change because of a move in the stock's price, a change in the analyst's estimate of the stock's fair value, a change in the analyst's assessment of a company's business risk, or a combination of any of these factors.

The Morningstar Rating for stocks includes a small buffer around the cutoff between each rating to reduce the number of rating changes produced by random market "noise". If a Rs 50 stock moves up and down by Rs 0.25 each day over a few days, the buffer will prevent the star rating from changing each day based on this insignificant change.

Do companies pay to have their stocks rated?

No.

How does the methodology for the Morningstar Rating for stocks differ from the methodology for the Morningstar Rating for funds?

Funds and stocks are different investment vehicles and therefore should be analyzed--and rated--differently. The Morningstar Rating for funds describes how well a fund has balanced return and risk or volatility in the past. The Morningstar Rating for stocks uses projections of a company's future operating performance to estimate whether the stock is overvalued or undervalued.

Evaluating an individual security requires a different approach than sizing up a portfolio of stocks; our ratings for stocks and funds are designed to do two different things.

When evaluating a mutual fund, an investor is essentially judging the past performance of a portfolio manager, the fund company, the cost structure, and the investment strategy to determine if the fund deserves a place in his or her portfolio. Our rating for funds is a backward-looking description of how the fund has balanced return and risk or volatility in the past, and it is a useful tool for paring down an immense universe of mutual funds.

When evaluating an individual stock, you need to estimate future cash flows and earnings. The Morningstar Rating for stocks is designed to tell investors if a stock's current price is greater than or less than our estimate of the stock's fair value, based on the potential future earnings and performance of the company. While historical performance is given consideration when our analysts make their estimates, the Morningstar Rating for stocks is forward-looking.

The Morningstar Rating for funds:

-

Is a descriptive, backward-looking measure of historical performance

-

Is strictly quantitative--there is no analyst input or opinion

-

Combines return and risk (volatility)

-

Is calculated once per month

-

Compares funds with their peers in specific investment categories

-

Has a fixed distribution of stars--10% of funds within each category receive 5 stars, 22.5% receive 4 stars, 35% receive 3 stars, 22.5% receive 2 stars, and 10% receive 1 star

The Morningstar Rating for stocks:

-

Is a measure of whether or not the stock is over- or undervalued based on forward-looking estimates

-

Is risk adjusted

-

Is based on both quantitative and subjective inputs--it includes analysts' opinions, which are embedded in their estimates of future cash flows

-

Is calculated daily

-

Does not divide stocks into comparison groups, nor does it have a fixed distribution of stars--the percentage of stocks receiving 5 stars will fluctuate daily.

Although we use different methodologies, both result in a meaningful, independent rating that is easily understood.

Does the Morningstar Rating for stocks include a risk component?

Yes. The margin of safety required for a given star rating is higher for companies for which we have less confidence in the fair value. As a result, companies with high levels of risk--whose cash flows are hard to forecast--will tend to have lower star ratings.