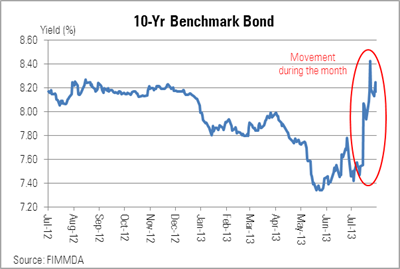

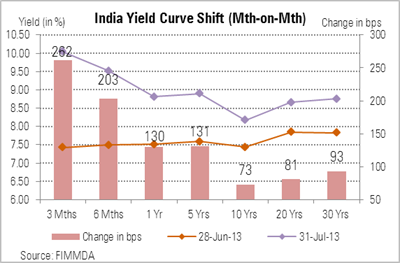

It was a month of carnage in the Indian fixed income markets, as the RBI took several steps to suck out liquidity from the system, in its efforts to curb volatility in the Indian rupee. The yield of the new 10 year benchmark government bond (7.16% GOI 2023) finally closed the month at 8.17%--up 73 basis points (bps) from previous month’s close. The benchmark yield is up by more than a percentage point from a low of 7.11% it hit on May 24. At one point in July, the 10 year yield had climbed to level of around 8.5%, but later subsided.

On late July 15, the RBI hiked the Bank Rate and the Marginal Standing Facility rates by 200 bps each to 10.25%, and capped the overall borrowing under its Liquidity Adjustment Facility at 1% of banks' Net Demand and Time Liabilities, or around Rs. 750 billion. The central bank also announced an OMO auction for July 18, which further helps to squeeze out liquidity from the system. RBI’s measures effectively increased the cost of short-term funding by around 200 bps, and were aimed at sucking out liquidity from the system, thus making it difficult for players to speculate on the rupee. The rupee had breached the psychological mark of 60 to the US dollar, and was approaching close to the 61 mark in early July.

However, debt markets reacted in an extreme fashion to these announcements, the next day (July 16), with short term rates climbing by 150-200 bps in a single day, and the benchmark 10 year yield rising by more than 50 bps during the day. This was the sharpest one-day spike seen in the benchmark 10 year yield since January 2009 (or around 4-and-a-half years), and it closed the day at 8.07% on July 16—up by 52 bps from previous day’s close of 7.55%.

The rupee recovered a bit, but still remained structurally weak. As a result of that, RBI announced fresh steps to squeeze liquidity on July 23, on the back of actions it had taken on July 16. The central bank revised the cap on individual banks' borrowing from its Liquidity Adjustment Facility to 0.5% of bank's net demand and time liabilities, from 1% earlier. It also raised the minimum amount to be maintained under bank’s Cash Reserve Ratio (CRR) on a daily basis to 99% of the requirement from the previous 70%.

These measures further squeezed out liquidity from the system, and took a toll on bond yields, the next day (July 24). The 10 year benchmark yield climbed to levels of around 8.5% on July 24, and finally closed the day at 8.42%--up 25 bps from previous day’s close. However, the 10 year yield fell over the next few days, and closed the month at 8.17% mark, as the rupee stabilized a bit after RBI’s recent actions.

Meanwhile, the RBI kept the key policy rate and the CRR unchanged in its monetary policy review on July 30, as expected by the markets. The undertone of the policy text was perceived to be surprisingly dovish by the markets. The RBI said that it would roll back the recent liquidity curbs once stability in the foreign exchange market is restored, and stability in the exchange rate will enable reverting to a growth-supportive policy stance. However, the RBI Governor’s comment that the cost of issuing dollar-denominated sovereign bonds at present outweighs the benefits, put pressure on domestic bond yields.

Also, the recent rise in US treasury yields kept pressure on Indian bond yields. The 10 year benchmark US treasury yield rose beyond the 2.7% mark in the beginning of July, but later fell a bit to close the month at 2.6%--up 8 bps from previous month’s close. The 10 year US treasury yield is now up more than a full percentage point from a 2013-low of around 1.6% at the beginning of May 2013.