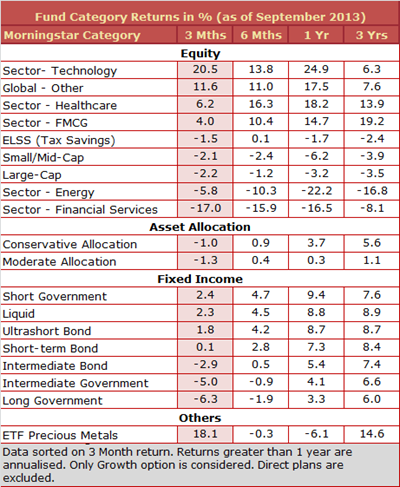

It was a bad quarter for interest rate sensitive stocks /sectors, as the RBI took several steps to squeeze out liquidity from the banking system, in a bid to control the falling rupee. Bond yields surged during the quarter, and the central bank surprised markets by hiking the repo rate on September 20, 2013. Financial sector funds especially took it hard on the chin, and delivered an average return of -17.0%, compared to -17.3% returned by the benchmark S&P BSE Bankex index. Banking stocks did recover in the month of September, but the damage in the months of July and August were enough to cause the sector to close the quarter quite deeply in the red.

Meanwhile, the falling rupee helped technology sector funds to shine during the quarter, and deliver an average return of 20.5%, compared to 25.3% returned by the benchmark S&P BSE IT index. Technology stocks did see some minor profit booking in the month of September as the rupee recovered, but posted significant gains in the previous two months.

Global feeder funds also benefited from the falling rupee during the quarter. Outperformance by various international markets also helped these funds to stand out, as domestic markets remained under pressure. The Morningstar Global – Other category delivered a return of 11.6% during the quarter.

Large-cap equity funds delivered an average return of -2.2% during the quarter, compared to -1.4% returned by the S&P BSE 100 index. Small/mid-cap equity funds returned an average -2.1% during the quarter, faring better than the CNX Midcap index and the S&P BSE Small-cap index, which returned -4.7% and -3.1% respectively over the same period. However, YTD in 2013 small/mid-cap equity funds have suffered more than their large-cap counterparts, and are down by an average 13%.

It was a very volatile quarter for fixed income markets. The yield of the 10 year benchmark 7.16% 2023 government bond rose to 9.23% on Aug 19, but then later fell, after the rupee recovered. However, in late September, yields rose again after the RBI surprised markets with a repo rate hike in its September 20 policy review. The 10 year yield closed the quarter at 8.77%--up more than 130 bps from previous quarter’s close. Duration products were generally hit, and long term gilt funds were the bottom performers from the fixed income space, delivering an average return of -6.3% during the quarter. Shorter tenure funds outperformed and short term gilt funds were the top performers, delivering an average return of 2.4% during the quarter, followed closely by liquid funds, which delivered an average return of 2.3%.

Gold ETFs delivered a strong quarterly return of 18% during the quarter, mainly benefiting from the rupee depreciation and also some recovery in international gold prices. Gold ETFs posted strong double-digit returns in the months of July and August, but delivered an average return of almost -10% in the month of September.