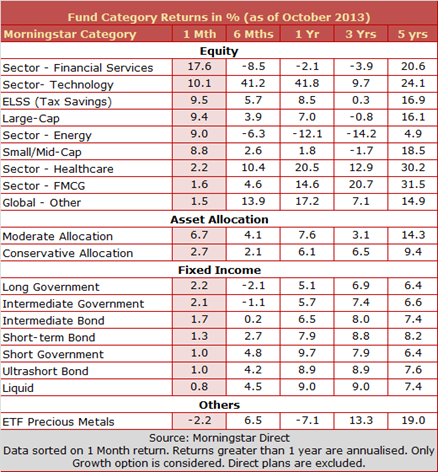

With markets on a high in October, diversified equity funds recovered smartly—delivering their best monthly return since January 2012. Large-cap equity funds returned an average 9.4% in October compared to 9.6% returned by the S&P BSE 100 index. Small/mid-cap equity trailed close behind, delivering an average 8.8% return in October, compared to 7.7% returned by CNX Midcap index. However, small/mid-cap equity funds are still down by an average 5% so far this year.

Among sector funds, financial sector funds were back with a vengeance, and topped the charts in the month of October 2013. They delivered an average return of 17.6% during the month, which is again the best monthly return posted since January 2012. Financial sector funds suffered large losses in the months of June to August, with the interest rate environment changing dramatically, and bond yields hardening substantially during this period. Even with the recent recovery seen in the months of September and October, these funds are down by an average 12% so far in 2013. Incidentally, the financial sector still continues to be the top holding of diversified equity funds with an average exposure of 20.5% at the end of September 2013, although exposure is down substantially from an average 25.7% at the end of June 2013.

The rupee factor continued to work to the benefit of the technology sector, with these companies expected to post strong corporate earnings during the September quarter. Technology sector funds delivered an average return of 10.1% in October, helping to push up their YTD return in 2013 to a strong 41%. Meanwhile, defensives like FMCG and healthcare underperformed during the month of October.

With bond yields subsiding during the month of October, duration products like medium and long-term gilt funds outperformed—delivering an average return in excess of 2%. The 10 year benchmark yield finally closed the month down 15 bps. Short term rates fell quite significantly, as the RBI rolled back some of its earlier liquidity tightening measures.

Gold ETFs fell by an average -2.2% in the month of October, on the back of almost a 10% loss in the previous month as well. YTD in 2013, gold ETFs have delivered an average return of -5.2%.