Cash is not always king

Investors often think of cash as a safe haven. Many investors will shy away from the stock market, unwilling to take on the added risk and afraid of possible losses.

Since the 2008-09 Global Financial Crisis, investors have been living with near-zero interest rates. Even as the

U.S. Federal Reserve is now only slowly normalizing policy, at a very gradual pace. Most other countries are still looking to maintain a low interest rate policy.

This ongoing era of ultra-low interest rates has depressed the yields offered on interest-bearing cash accounts to near-zero or even below zero to negative, in the case of some countries.

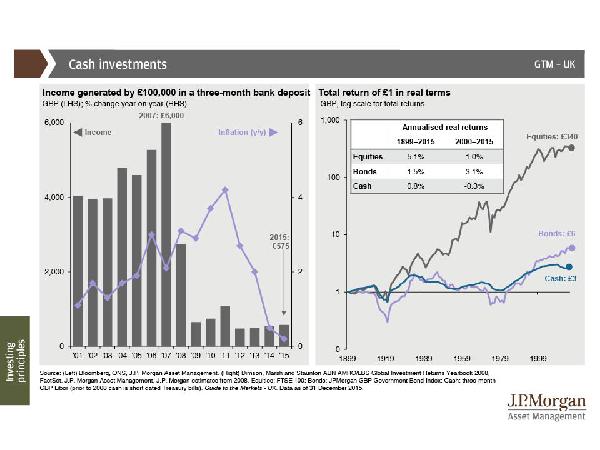

Left chart: Cash pays less.

Right chart: Cash underperforms over the long term.

Action Point: Cash savings are vulnerable to erosion by inflation over time. Investors should be sure an allocation to cash does not undermine their long-term investment objectives.