Volatility is normal

Investors should keep in mind that volatility is normal, significant drawdowns are part of the nature of equity investing and occur in most years. Though impossible to predict, every year has its rough patches.

For disciplined investors, market volatility and downturns can represent an opportunity to acquire more shares at a better price, provided, of course, they are willing to take a long-term view that markets will grow over time.

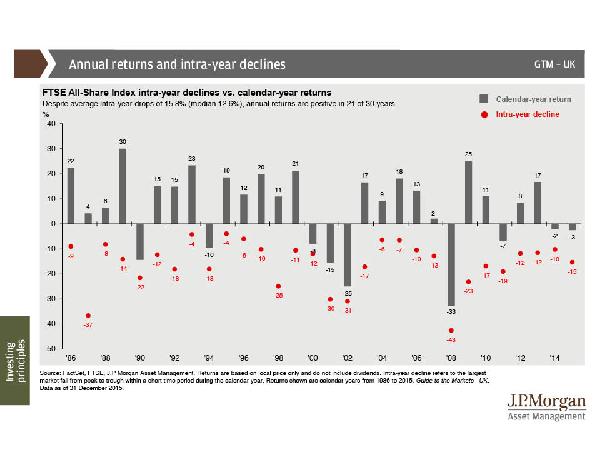

Chart: The red dots represent the maximum intra-year equity decline in every calendar year, or the difference between the highest and lowest point reached by the market in those 12 months. It is hard to predict these pullbacks, but double-digit pullbacks in markets are a fact of life most years. Investors should expect them.

It's important to have a plan for when the going gets tough, instead of reacting emotionally. The grey bars represent the full-year market index returns from 1 January to 31 December. They show that, despite the pullbacks every year, the equity market has gone on to deliver positive returns in most calendar years.

Action Point: Volatility is normal. Don't let it derail you. Don't panic. More often than not a stock market pullback is an opportunity, not a reason to sell.