Most trusted source of investment advice

Around 65% of advised retail investors worldwide say that their financial adviser is the most trusted source of investment advice, shows a CFA survey titled The Next Generation of Trust. This was followed by advice from other sources like friends and family (10%), online research (8%), academic experts (4%), investment newsletters (4%) and so on.

While selecting a financial adviser, retail investors assigned higher importance to trustworthiness over investment performance. On the other hand, the common reasons why they leave their advisers are underperformance and a lack of communication or responsiveness.

The online survey was conducted in 2017 among 3,127 retail investors aged 25+ years old with investable assets of at least US$100,000 in the United States, Canada, Brazil, the United Kingdom, France, Germany, the United Arab Emirates, Australia, India, Singapore, China, and Hong Kong, China SAR.

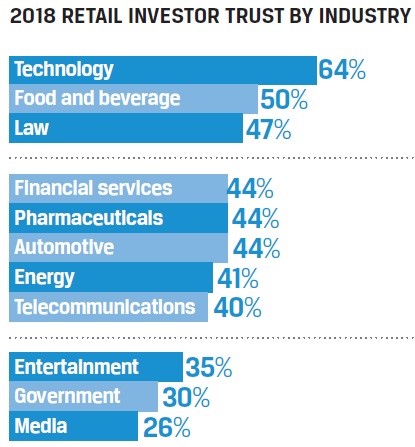

Interestingly, the survey found that trust among retail investors for financial services has moved up, partly due to the recent strong market returns. Meanwhile, industries like media and government are becoming actively distrusted at levels double the distrust of financial services (about 40% vs. 20%, respectively). Technology continues to be the most trusted industry by a wide margin, which the research says is an opportunity for financial services.

Trust by age

The study found that younger investors are more trusting of financial services than older counterparts. “This raises the question about whether trust is diminished over time and if the industry can find ways to maintain trust levels through the investor life cycle,” the study recommends.

What investors want

When investors were asked to rate their trust factors related to actual experiences, the results were positive. Most retail investors feel that their advisers are accessible, transparent and fair. Eighty-three percent investors said their advisers are accessible. Those whose advisers were more accessible were also more likely to trust the industry overall (54% vs. 30% trust levels).

In terms of transparency, most retail investors said their adviser was very or somewhat transparent around fees, market events, and other items, though less than half thought their adviser was very transparent around conflicts of interest. Regarding fees, 72% thought the fees they paid were fair, 10% thought they were unfair, and 18% were unsure.

Importance of investment firm brand to retail investors

When considering an investment firm, 46% retail investors said that a trusted brand is more important than “people I can count on.” Brand is more than just advertising; it encompasses how people perceive and feel about a person or business. This makes relationship building more valuable, including community outreach, corporate social responsibility programmes and other types of philanthropy. In fact, 44% of retail investors globally said they would be more trusting of an adviser or firm that worked as a philanthropic partner for community efforts.

Technology enhances investor trust but does not replace the need for humans

Investors of all ages and regions want more technology applied to investing and trust in technology is generally high. Effective use of technology increases trust in a financial adviser or firm and blockchain holds potential for more trust in the system. For advice, however, people are much more trusted and robo-advisers are the least trusted segment of the industry.

The study provides eight steps for financial services industry, including advisers, to increase credibility and professionalism:

Credibility

- Maintain strong brand identity and follow through on brand promises

- Employ professionals with credentials from respected industry organizations

- Stay focused on building a long-term track record to demonstrate competence

- Adopt a code of conduct to reinforce your firm’s commitment to ethics

Professionalism

- Improve transparency and clarity regarding fees, security, and conflicts of interest

- Use clear language to demonstrate that client interests come first

- Showcase your ongoing professional development to improve investment knowledge

- Demonstrate your dedication to the values that clients hold dear

Edited excerpts from the study The Next Generation of Trust.