New talent

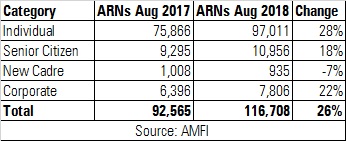

As industry assets crossed a new high of Rs 25 lakh crore in August 2018, new distributors are flocking the industry. The latest AMFI data shows that the mutual fund distribution force has grown by 26% from 92,565 in August 2017 to 1.16 lakh in August 2018. Distributors are divided into four categories: individuals, senior citizens, new cadre and corporate. Interestingly, of 24,143 new distributors who have joined so far, 88% belong to the individual category.

It is not only individuals who are taking to mutual fund distribution. The distribution space is attracting talent from asset management firms, wealth management/banks and new age robo advisers that are backed by private investors. The industry added 1,410 distributors in the corporate category in August 2018.

The B30 push

Of the fresh AMFI Registration Number, or, ARN, registrations in August 2018, the highest registrations (22.5%) were from Maharashtra, followed by Gujarat (9.41%) and West Bengal (6.88%).

That said, new ARN registrations from B30 markets are also increasing. In August 2018, about 36% of overall registrations were from B-30 towns. Smaller towns are gaining a lot of traction after Securities and Exchange Board of India, or, SEBI, allowed a higher incentive for these distributors. Coupled with this, the awareness campaigns unleashed by Association of Mutual Funds in India, or, AMFI, is helping attract new investors in MF fold. Assets from B30 locations grew by 5% from Rs 3.41 lakh crore in July 2018 to Rs 3.58 lakh crore in August 2018. Reflecting this trend, retail folios in B-30 towns increased from 2.86 crore in July to 2.92 crore in August.

Growth in ARN registrations

The total number of mutual fund distributors registered with AMFI (i.e. ARN holders) as on August 31, 2018 was 1.16 lakh (which includes 7,806 non-individual ARN holders). There are 1.49 lakh employees of mutual fund distributors holding EUINs.

The way ahead

While the recent SEBI regulation to cap upfront commissions could be a roadblock for new distributors, industry experts believe that this will not deter serious players as our market is still untapped.

While the increasing distribution force is a healthy sign, the industry needs to do much more to cater to India’s vast population, especially to reach out to people who are not digital savvy. Life Insurance Corporation, which completed 63 years of operations in India in 2018, has 11.48 lakh agents. Reaching even 50% of LIC’s distribution force can go a long way in expanding the reach of mutual funds among households.