India’s wealthiest people on average employ two wealth managers and their primary criteria for choosing them are a compelling investment track record and an impressive company reputation, finds a recent survey conducted by IIFL in partnership with Wealth-X. The study titled IIFL Wealth Management Wealth Index 2018 presents an overview of India high net worth clients.

The survey, conducted in early 2017, covered 500 wealthy participants from across India. The participants were analyzed into three key groups, based on net worth: high net worth individuals (HNWIs) with a net worth between Rs 65 million and Rs 650 million, very high net worth individuals (VHNWIs) with a net worth between Rs 650 million and Rs 2 billion, ultra-high net worth individuals (UHNWIs) with a net worth of Rs 2 billion and above.

India has 2.84 lakh wealthy individuals with a combined fortune of Rs 95 trillion. By 2021, that figure is expected to reach Rs 188 trillion. The survey also presents key insights into what the super-rich expect from their adviser. The Indian wealthy may have a fiercely domestic focus in business but, when it comes to choosing an investment adviser, their search for the very best is influenced by the global outlook the wealth manager can provide.

Cash rich, time poor

India’s wealthy elite are out of their comfort zone when it comes to managing their wealth. While they are cash and asset rich, these people are time poor and require external advisers to help them manage their fortunes and preserve their wealth. Long working hours and the challenges of building up business empires means that 60% of the wealthy in India do not have time to manage their own investments. This is particularly the case among the women and also HNWIs, who are still earlier in the curve of their business career.

Trust for adviser

An overwhelming 86% of wealthy Indians check on their investments regularly and 97% of UHNWIs do so. The pattern appears to be that the more liquid the assets, the more the portfolios are checked, with more steady assets such as property or precious metal being less of an ongoing concern. This high level of engagement – or checking up on portfolios – stems from an inherent mistrust of devolving responsibility for wealth management to a third party. One third of respondents admitted that they did not trust others to make financial decisions for them.

Notably, those whose primary financial goal is to increase their wealth are more trusting, with 78% prepared to hand decision-making to others. The inheritors tended to be less trusting, with almost half saying they would not devolve such decisions to outsiders.

Within the demographic, some interesting facts emerged:

- Women are more willing to bestow trust than men

- Men and those aged under 55, in particular, are more likely to want an adviser to challenge their ideas. This indicates that while they want their advisers to be proactive in their investment strategy and to initiate ideas, the wealthy want to be active in the decision-making process.

- 77% of men welcome challenges to their ideas compared with 59% of women

Product knowledge

The understanding among the wealthy of different asset classes is modest, with less than half admitting to a good understanding of equities or investment funds. This knowledge gap is all the more marked given that 84% hold at least some of their wealth in investment funds, yet close to 60% do not have a good understanding of how these work:

- Of those invested, less than half (43%) have good understanding of the asset class

- Some 15% admit to having little or no understanding of investment funds

- The best understood asset class is equities, with 42% claiming to have either very good knowledge or professional expertise in this area

- But less than 20% have a good grasp of structured products or private equity (18% and 15% respectively)

- Almost half of India’s wealthy (45%) confess to a poor understanding of private equity

Those groups with the best knowledge across all investment asset classes, including equities and private equity, are men, UHNWIs and those under the age of 55. The UHNWIs stand out for their superior knowledge and this is a reflection of their high level of engagement with their portfolios.

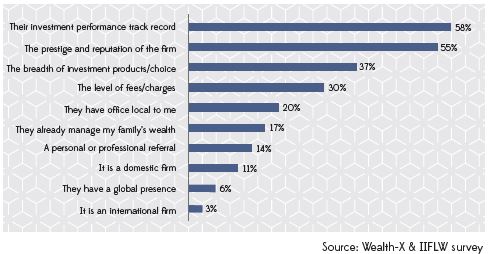

Criteria for choosing an adviser

For the super wealthy, an investment company’s standing and track record are the foremost criteria when it comes to appointing a wealth manager. Outstanding investment performance was ranked first by 58% of India’s richest individuals when choosing the best person to manage their wealth.

Wealthy clients also want an investment manager who offers the full portfolio of investment asset classes, with 37% citing this as a factor in their decision making.

Fees also attract close scrutiny among the HNWIs, with this becoming increasingly important as we travel up the wealth ladder: the richer the client, the more mindful they are of how much of their money is being eaten up by fees.

What makes investors stick with the same adviser for a long period is transparency. Opaque advice is a real turn-off for the rich. Clear information about the portfolio structure was important to 96% of investors and clear information on the nature of the investments was important to 99%. Fee transparency is just a little less important, cited by 84% of the wealthy in general, but this becomes ever more important to the most wealthy UHNWIs.

Important factors when choosing a wealth manager

Tenure of service

Once a wealth manager has been appointed, the average tenure of service is around six years. The wealthiest Indians and those aged over 55 are likely to have spent more than five years with the same adviser.

In total, 55% use just one wealth manager. But the richer the individual, the more likely they are to have multiple advisers to manage their fortunes. UHNWIs are significantly more likely to engage three or more wealth managers, whereas the majority (82%) use one or two.

What kind of services are the super-rich looking for?

- 88% percent want investment management advice

- Just over half want tax planning, with this being a particular focus for women

- UHNWIs seek trust and estate planning

Access the full report here.