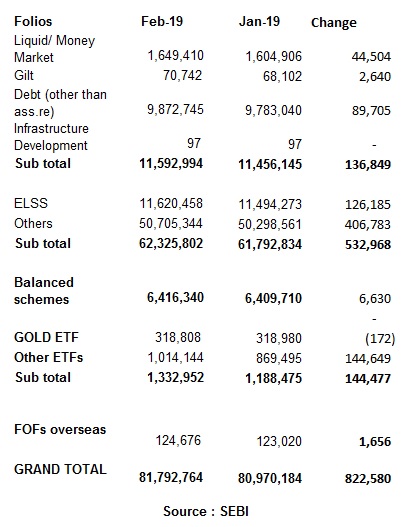

While the overall inflows in equity funds are abating, the industry continues to add new folios or investor accounts. In February, the mutual fund industry added 8.20 lakh folios. As a result, the total investor base of the industry went up from 8.09 crore in January 2019 to 8.17 crore in February 2019. Around 65% of this growth was contributed by equity funds which added 5.32 lakh folios.

Assuming each investor holds five folios, the industry has 1.63 crore unique investors. As on March 2018, the ticket size for equity-oriented funds stood at Rs 1.55 lakh per account.

Equity ETFs gaining traction

Exchange traded funds which track equity indices were another significant contributor (18%) to the growth in the folios. ETFs added 1.44 lakh folios in February 2019. This category is gaining traction as the government is divesting its stake in public sector utilities through ETFs. Also, Employees’ Provident Fund Organization (EPFO) is investing in equity ETFs since January 2017. Thus, ETF folios (excluding Gold ETFs) have gone up from 7.39 lakhs in February 2018 to 10.14 lakhs in February 2019.

Debt funds

Debt funds added 1.36 lakh folios in February 2019. Liquid funds (44,504) and other debt funds 89,705 (excluding gilt funds) majorly contributed to this growth. The total folio base in debt funds stands at 1.15 crore as on February 2019. Debt funds are mainly popular among institutional and high net worth individuals. Debt funds have a higher ticket size per folio as compared to equity funds. The average ticket size in liquid funds and debt funds is Rs 30.63 lakh and Rs 8.28 lakh respectively.

Folio growth during Jan-Feb 2019

Overall, industry’s folio base has doubled from 4.03 crore in December 2014 to 8.17 crore in February 2019.