Even as overall equity flows are on the decline, investors continue to have faith in systematic investment plans (SIPs). Inflows from SIPs increased marginally in February 2019 at Rs 8,095 crore as compared to Rs 8,064 crore in January 2019. As a result, the total SIP folios increased from 2.57 crore to 2.59 crore during the same period.

Consistently rising inflows has helped the industry collect Rs 84,638 crore this fiscal, which is 26% higher in comparison to Rs 67,190 collected in Rs FY17-18. Assuming the industry gets combined inflows of Rs 16,000 crore in March and April, the total inflows through SIPs will cross the Rs 1 lakh crore mark this fiscal.

Interestingly, inflows through SIPs have doubled from Rs 43,921 crore in FY16-17 to Rs 84,638 crore this fiscal.

AMFI data shows that the industry has added about 9.15 lacs SIP accounts each month on an average during the FY 2018-19, with an average SIP size of about Rs 3,125 per SIP account.

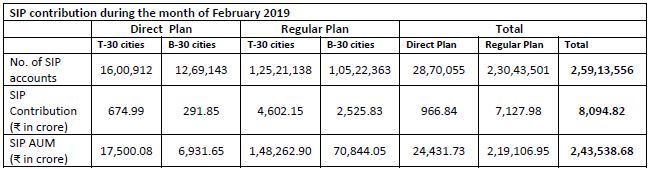

Of Rs 8,095 crore SIP inflow received in February 2019, 88% or Rs 7,128 crore has come through regular plans while the remaining through direct plans. The SIP assets under management stands at Rs 2.43 lakh crore. Of this, 90% or Rs 2.19 lakh crore is in regular plans.