Credit risk funds which are facing tough times due to the ongoing turmoil in debt market continued to see net outflows of Rs - 4,156 crore in May 2019, shows the latest Association of Mutual Funds in India (AMFI) data. In April, the category had seen net outflow of Rs - 1,253 crore.

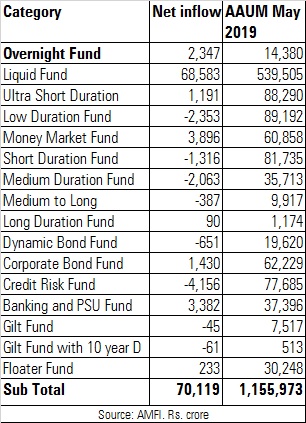

Income/Debt

In the debt category, other sub-categories which saw net outflows were gilt funds (Rs -106 crore), dynamic bond funds (Rs - 651 crore), medium to long duration (Rs – 387 crore), medium duration (Rs -2,063 crore), short duration (Rs – 1,316 crore) and low duration (Rs - 2,353 crore). On the other hand, banking and PSU funds, corporate bond, long duration, money market, ultra short, overnight and liquid funds received net inflows. Liquid funds received bulk of the inflows at Rs 68,583 crore in May 2019 which accounted for the total Rs 70,119 crore net inflows in debt funds.

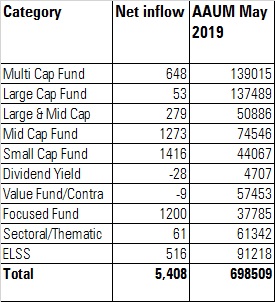

Equity

Equity schemes received net inflows of Rs 5,408 crore in May 2019. The NDA’s decisive win supported the sentiments in markets pushing the Sensex 2% in May. Market experts believe that the valuations in mid and small cap segment have become attractive which is turning investors attention to this space. Around 50% or Rs 2,689 crore of the total Rs 5,408 net inflows in equity funds came in mid and small cap funds. Focused funds, which invest in a concentrated portfolio of stocks, received Rs 1,200 crore net inflows. Mirae Asset launched its Focused Fund in May which mopped up Rs 754 crore during the NFO period.

Index funds and exchange traded funds which track the equity indices collected net inflows of Rs 2,652 crore.

Overall, the industry collected Rs 76,989 crore, largely on account of inflows in liquid funds. The average assets under management of the industry increased marginally by 1% from Rs 25.27 lakh crore in April 2019 to Rs 25.43 lakh crore in May 2019.