The assets under management of mutual funds went up by 1% from Rs 24.25 lakh crore in June 2019 to reach Rs 24.53 lakh crore in July 2019 largely on account of healthy inflows in debt funds which received Rs 61,846 crore net inflows.

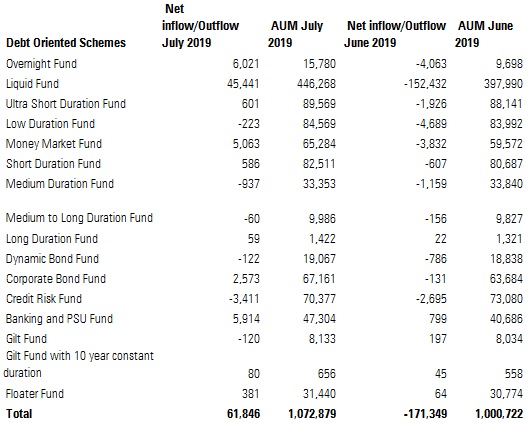

Open End Debt Funds

After seeing massive outflows of Rs 1.71 lakh crore in June 2019 due to quarter end, this category received net inflows of Rs 61,846 crore in July 2019. Liquid funds received the large share of inflows at Rs 45,441 crore, followed by overnight funds (Rs 6,021) crore, banking and PSU funds (Rs 5,914 crore). Credit risk funds continued to see outflows in July at Rs -3,411 crore, signaling a flight to safety. Open end debt schemes AUM stood at Rs 10.72 lakh crore as on July 2019.

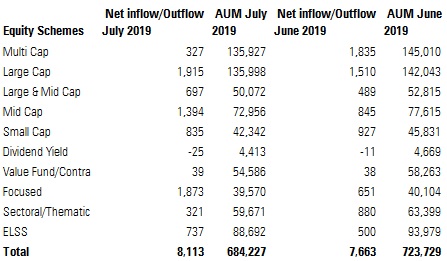

Equity

Even as markets remained choppy, net inflows in equity funds increased by 6% from Rs 7,663 crore in June to Rs 8,113 crore in July. A majority of the inflows came in large cap funds (Rs 1,915 crore), followed by Focused Funds (Rs 1,873 crore) and mid cap funds at Rs 1,394 crore.

There has been a correction across market lately which has presented an opportunity for investors to buy. Over a one-year period, BSE Mid Cap, Small Cap and BSE 100 indices have corrected by -16%,-25%, and -5% respectively.

“Despite a difficult month and volatile market conditions, the overall sentiment toward debt, equity and hybrid mutual fund schemes has been positive,” said N S Venkatesh, CEO, AMFI. Collections from systematic investment plans (SIP) inched up from Rs 8,122 crore in June to Rs 8,324 crore in July.

New Fund Offers

The industry collected Rs 15,797 crore from new fund offers in July. A major chunk of this money came in exchange traded funds ICICI Prudential Bank ETF; CPSE ETF FFO 5 (Further Fund Offer) and Reliance ETF Sensex Next 50 which collectively mopped up Rs 11,533 crore.

Kotak Focused Equity Fund collected Rs 1,159 crore while Mirae Asset Mid Cap Fund mopped up Rs 612 crore.