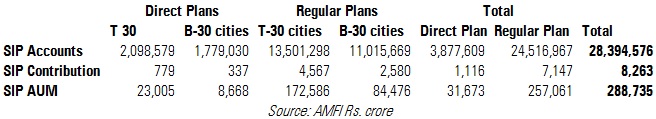

When it comes to investing through systematic investment plans, a majority of investors prefer to invest through distributors. The latest Association of Mutual Funds in India (AMFI) data shows that of Rs 8,263 crore collected through SIPs in September 2019, inflows from regular plans SIPs stood at Rs 7,147 crore, which account for 86% of the total inflows.

The industry added 8.50 lakh new SIPs in September 2019 while 5.63 lakh SIP accounts were closed. As a result, the total SIP accounts touched 2.84 crore in September 2019 from 2.81 crore in August 2019. Reflecting this trend, the SIP assets increased by 6% from Rs 2.71 lakh crore in August 2019 to Rs 2.88 lakh crore in September 2019, accounting for 11.8% of total industry assets.

The SIP collections went up marginally from Rs 8,231 crore in August 2019 to Rs 8,263 crore in September 2019. Inflows through SIPs in direct plans went up by 4% from Rs 1,077 crore to Rs 1,116 crore during the same period.

That said, SIPs through online investment channels selling direct plans could increase going ahead with the rising digital wave. To tackle this challenge, many traditional advisers have also enabled their clients to set up SIPs online by partnering with stock exchange platforms and MFU.

SIP inflows in September 2019

Of Rs 1,116 crore inflow in direct plan SIPs in September, Rs 779 crore or 70% came from the top 30 cities while the remaining Rs 337 crore came from beyond top 30 cities, indicating that direct plans are yet to catch investors fancy in smaller cities.