Spooked by the recent credit events in fixed income market, retail investors seem to have exited credit risk funds in hordes. Retail folios in debt funds (excluding gilt and liquid) fell by as much as 57.85 lakh in the last one year. During the same period, retail folios in liquid funds witnessed a jump of 4.89 lakh, indicating a flight to safety.

Retail assets (across all fund categories) fell by Rs 40,281 crore in the last one year (September 2019-18). A large part of this fall was due to drop in assets under management in debt schemes. Retail assets in debt schemes fell by Rs -43,967 crore in the last one year.

Retail AUM in liquid funds dip

While the retail liquid fund assets dipped by Rs 3,605 crore, folios increased by 4.89 lakh. Retail investors typically have a low-ticket size and tend to hold multiple folios. The liquid category is dominated by corporates which account for 72% of the asset pie, followed by HNI at 19%. Overall, liquid fund asset base increased by Rs 93,488 crores from Rs 3.94 lakh crore in September 2018 to Rs 4.88 lakh crore in September 2019. Liquid funds account for 20% of the total industry assets.

Since liquid funds have started charging graded exit loads from October 20, 2019, fund managers believe that institutional investors will move to the overnight category. Anju Chhajer, Senior Fund Manager, Nippon India Mutual Fund, expects liquid fund assets to drop by 15-25%. “Institutional investors will move to overnight category or will invest directly in Triparty Repo (TREPS). This will also reduce the volatility of AUM of liquid fund as stable money only gets invested due to imposition of exit load. The norm of 20% investment in Cash T-bill and government securities may reduce the liquid fund gross yields by 5-10bps depending on the markets.”

Gilt funds

Retail folios in gilt funds increased by 51,402 while the assets under management fell marginally by Rs 91 crore. High net worth individuals (HNIs) too flocked to this category, which is evident by 8,372 new folio addition. Overall, the category added 60070 folios, 86% of which was contributed by addition in retail folios. Due to the easing interest rate regime, gilt fund category has delivered 14% return over a one-year period. Overall, the assets under management in this category increased by Rs 1,945 crore from Rs 8,018 crore to Rs 9,963 crore, which accounts for a merely 0.41% of the total industry AUM.

Debt schemes

Barring HNI, AUM in all other investor categories like retail, banks and institutions and FIIs fell. The AUM in this category fell by Rs -58,234 crore. The AUM in HNI category increased by Rs 25,199 crore. The drop in asset base was reflected in the corresponding drop in folio base. Investor accounts in debt schemes fell by 53.27 lakh. The highest drop was seen in the retail category which saw an erosion of 57.85 lakh folios.

Change in definition of HNI

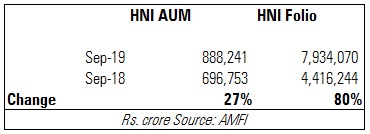

From March 2019, SEBI has changed the definition of retail investors as individuals investing up to Rs 2 lakh per transaction. As a result, HNIs are individuals investing upwards of 2 lakh per transaction (fresh investment not switch), effective quarter end June 30, 2019 onwards. This means that individuals (investing above Rs 2 lakh) who were previously tagged as retail folios have now migrated to HNI category. This is one of the reasons for 80% increase in HNI folios, say industry experts.

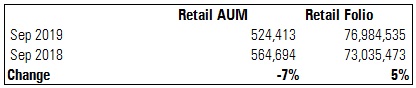

HNI folios increased from 44.16 lakh in September 2018 to 79.34 lakh in September 2019. Retail folios increased by 5% from 7.30 crore to 7.69 crore during the same period.

Retail equity folios see a rise

Overall, equity funds folio base (across all categories of investors) increased by 27.08 lakh from 5.91 crore in September 2018 to 6.18 crore in September 2019. Retail folios in equity funds increased by 10.69 lakh from 5.66 crore to 5.77 crore during the same period while folios in the HNI category increased by 14.38 lakh.

Retail folios (across all scheme categories) increased by 5% from 7.30 crore in September 2018 to 7.69 crore in September 2019, shows Association of Mutual Funds in India (AMFI) data.

There are 8.5 crore accounts in the mutual fund industry as on September 2019, of which 89.9% is held by retail investors.