Independent financial advisers, banks and national distributors still hold sway when it comes to channelizing money through systematic investment plans (SIP).

Of Rs 8,373 crore collected through SIP in November 2019, 85% inflows came through distributors while the remaining 15% came via direct plans. Direct plans may not necessarily mean it is from DIY investors. Many individual Registered Investment Advisers (RIAs) and online investment firms recommend direct plans.

Of Rs 1,205 which was channelized through direct plan SIPs, 69% came from T30 cities while the remaining 31% from B30 cities. This indicates that direct plans are yet to catch investors fancy in smaller towns.

The SIP assets crossed Rs 3 lakh crore mark for the first time in October 2019. In November 2019, SIP assets have touched Rs 3.12 lakh crore with 2.94 crore SIP accounts.

Of Rs 3.12 lakh crore SIP AUM, 94% share is in regular plans, indicating that IFAs, banks and NDs are playing an active role in championing the cause of SIPs. It remains to be seen how much of this share moves to RIAs.

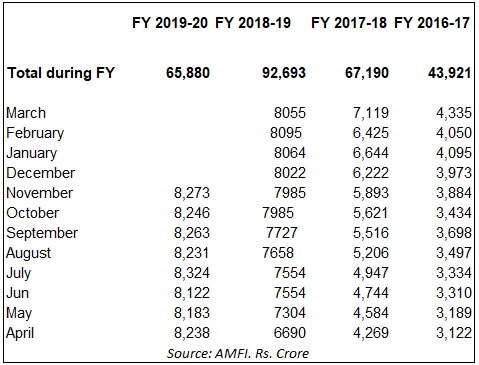

During April-November 2019, the industry collected Rs 65,880 crore through SIPs. In FY 18-19, SIP collections stood at Rs 92,693 crore.