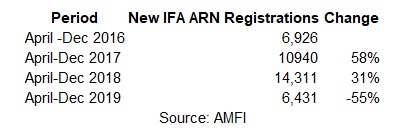

New Independent Financial Advisers (IFA) ARN registrations have dropped by 55% from 14,311 during April-December 2018 to 6,431 in April-December 2019.

Experts attribute the sharp drop in new enrollments to the clampdown on distributor commissions. This coupled with the shift to all-trail model seems to be deterring new talent to enter the industry. As on December 2019, there are over 87,000 ARN holders in individual category.

“Lack of upfront commissions may have discouraged new IFAs to enter the industry, especially from smaller towns. Besides, it is also a function of inflows. Overall, the inflows have come down in the industry. Only SIPs are getting traction,” said G. Pradeepkumar, CEO, Union Mutual Fund.

Net inflows in equity funds (excluding ELSS and balanced) have dropped by 36% from Rs 82,880 crore during April-December 2018 to Rs 53,391 crore in April-December 2019. During April-December 2019, SIP inflows stood at Rs 74,398 crore.

While the total number of ARN licenses in individual category has increased from 68,000 in 2016 to 87,179 in December 2019 the number of active ARNs still remains less.

Besides having a roadmap for expanding the distribution force, there is a dire need for the industry to motivate existing inactive ARN holders to rejoin the distribution force. According to CAMS data, the top 4,000 IFAs account for 95% of the total IFA assets in industry. This means, only 5% of IFA ARNs account for 95% of IFA AUM. Industry estimates suggest that IFA’s manage AUM of Rs 5.27 lakh crore, which is 20% of Rs 26.54 lakh crore industry assets as on December 2019.

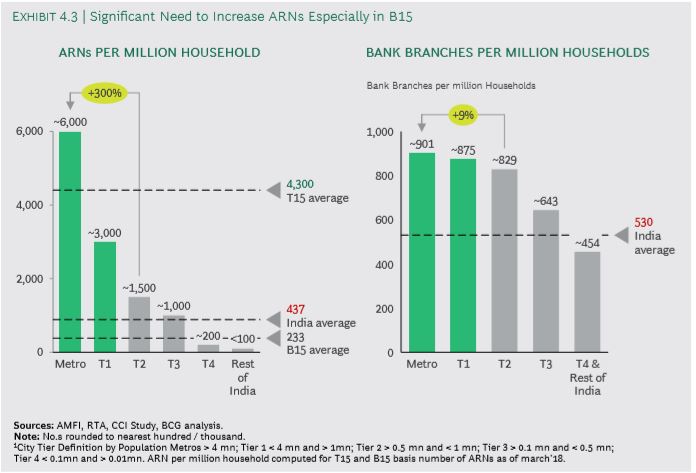

If we look at the geographical mix of the ARNs, 56% or 47,196 of ARNs are from T30 cities while the remaining from B30 cities. “The ARNs per million households in T15 cities are ~18 times higher than those in B15 cities. At the overall country level there are ~440 ARNs per million households. While the number in T15 cities is 4,300, it plummets to ~230 in B15 cities. This gap will have to be reduced quickly to meet the 100 trillion AUM aspiration,” shows BCG AMFI report.