Haresh Chawla is an angel investor and a partner at True North. He shares his views below, which have also been written and discussed on his Twitter timeline.

In 2019, India overtook France and UK to become the world’s fifth-largest economy; the other four being U.S., China, Japan and Germany.

Of course, it is a source of pride. Finance Minister Nirmala Sitharaman boasted about it when presenting Union Budget 2020.

But let us not forget that India is 145th in terms of GDP (nominal) per capita. Read that again; there are 145 countries ahead of us.

The optics of GDP

India has 1.37 billion mouths to feed, shelter and support.

Per capita income of India is approximately 5 times lower than world's average around of $11,673.

Here's the bigger tragedy. The "average" per capita income is $2000/annum, which is around Rs 11,000 a month. I put "average" in quotes because it is meaningless - over 80% of Indians earn lower than the average. The average fools us optically, makes us look better than we are. If a weighted average per capita income/median were to be used (which would be the best indicator of our consumption and spending power), we would rank far lower.

(In this World Bank blog, you can see the weighted average of per capita GDP of all the countries, with population being the weights. India and China have large shares in the world economy, but this is not due to their standard of living indicated by GDP per capita – their GDP per capita is below the world average – rather because of their large shares of the global population.)

While China is 5x on per capita income ($10,000), India actually has a steeper mountain to climb. Assume Indian and Chinese spend the same percentage on essentials. The disposable income gap nears 10x-15x. Disposable income, which fuels private consumption, gives an economy intrinsic growth drivers. We don't have much.

Our markets are smaller than they appear, and they are stagnant in some segments.

The job-creating MSME economy (micro, small, medium enterprises) is in distress, and being crowded out by better capitalised, larger firms, which will deploy more automation than people.

Markets are not growing. Market shares are growing.

Which is resulting in another optical fallacy - the Sensex/Nifty, comprised of big balance sheet, cash-rich firms, are in divergence with the real state of the economy. MSME's struggle with compliance, and credit-squeeze.

The “economy going through a process of detoxification” narrative is well and good. Of course, we need to remove bad blood, but transfusion of fresh blood has to be done simultaneously. Else we'll have a situation where the operation has been successful, the blood has been drained, but the patient is dead.

The formal economy is growing, but those statistics hide the pain in the larger economy, where neither jobs nor taxes are growing. They are falling.

Even as we celebrate ever-rising stock indices, let’s not lose sight of the fact that what the Indian economy needs is for small firms to grow and thrive, to employ and skill, to borrow and invest.

The structural changes

While everyone’s attention is on the headline GDP number and how it is moving, the problem below the hood - in the interplay between underlying drivers of growth - is far severe.

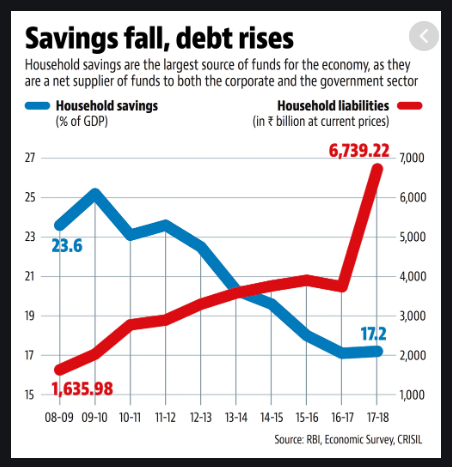

The rising tide of consumer spending (and borrowing) is on the ebb. For the past decade Indian consumers have been Spending from their Savings, driven by aspiration, confidence, and easier credit. Now they are Saving from their Spending. The negative wealth effect over the last few years has stalled spending.

Ideally, people should earn more, save more AND spend more. Our earnings have been slow for a while, but we dipped into our savings and spent. Then borrowing became easy and we borrowed and spent even more.

Source of the above graph: Hindustan Times

The GDP slowdown has been masked for a decade by this one-time shift in our savings pattern. It covered for problems in all other facets of the economy. The underlying core economy has been weakening through the decade and the cracks have inevitably shown up now.

Private investment has been lethargic. Government capital spending caught up in litigation and inefficiency. Exports haven’t received the fillip they desperately needed.

The mask of consumer spending is now off and the economy needs an infusion of confidence, consistency and capital to get moving. We need private capital to get rushing through our veins again backed by government infrastructure spend, and reform.

The call to introspect

Economies (like companies!) don’t flounder because they lack data, knowledge or smart and competent people. They flounder due to competent people who fail to accept the problem, and fail to respect the second order effects of their actions on complex systems.

The soft issues of signaling, confidence and right allocation of resources, and hard reform matter as much as the hard aspects of incentives, taxes and interest rates. It needs greater introspection.

Governments cannot solve all problems - but they have an obligation to create conditions in which people and firms work together to solve problems.

Accepting reality is a beginning.

And the reality is that temporary stimulus and announcements will merely postpone things and may give diminishing returns. Some may not even work anymore. Structural, hard reform is the need of the hour.