A CFA Institute study titled Earning Investors’ Trust shows that while technology is more important for retail investors than having access to human advice, 73% of retail investors are more likely to trust a human adviser over robos.

Access to technology

While only a small number of investors (13% of retail investors and 16% of institutional investors) would consider leaving their investment firm because of a lack of sufficient technology, when forced to choose between access to technology tools and access to a human, the trend has been to favour technology tools. For the first time, retail investors in aggregate have an equal preference for technology and people, and in 10 of 15 markets, the majority of retail investors prefer technology.

Thus far, technology in the investment industry has mostly had the effect of making processes more efficient and giving clients greater access to information. The coming shift will be from doing things faster with technology to doing things better with technology, and it will be a more difficult transition for investment firms to make.

Here are some other interesting finds from the study:

Gaining trust

Information is essential for trust. The less investors feel informed, the less they trust the financial system. Investors become better informed through information and knowledge derived from financial education.

The following have positive impacts on investor trust: strong performance track record, professional credentials, adoption of industry codes, demonstration of ongoing professional learning, and a strong brand.

Trust level

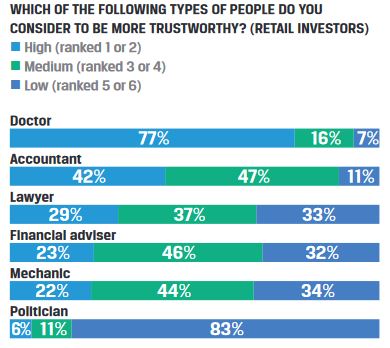

More than three times as many people highly trust doctors relative to financial advisers, who rate on a par with mechanics.

Top goals of investors

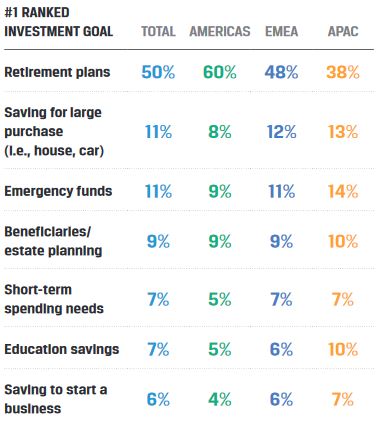

Across regions, the top investment goal for retail investors is retirement. By market, this is the case everywhere except mainland China, where providing for beneficiaries is prioritized, and India, where top goals also include emergency funds and saving to start a business.

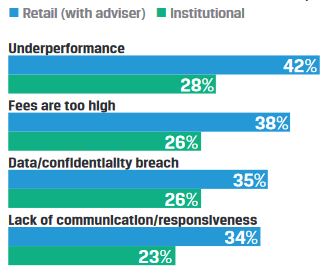

Why investors leave advisers

Artificial Intelligence

A strong majority of institutional investors (71%) are eager to invest in funds that employ artificial intelligence (AI) in the investment process. Artificial intelligence needs to be combined with human intelligence, including judgment and economic intuition. The desire for a blend is also evident in retail investors’ response to a question about whether they would prefer a financial adviser that is data-driven and very quantitative (39% selected this) or has economic intuition and extensive market experience (61% selected this).

A fair system

For retail investors without an adviser, only 57% say they have a fair opportunity to profit by investing in capital markets, but this increases to 81% for those with an adviser.

The fee conversation

A significant majority of retail investors (83%) and institutional investors (75%) surveyed agree that one of the most important items in creating a trusted relationship is fully disclosing fees and other costs.

The online survey covered 3,525 retail investors and 921 institutional investors across Australia, Brazil, Canada, Mainland China, France, Germany, Hong Kong SAR, India, Japan, Mexico, Singapore, South Africa, United Arab Emirates, United Kingdom, and United States.