A decline in mutual fund sales coupled with shrinking margins hurt the margins of most large distributors in FY20.

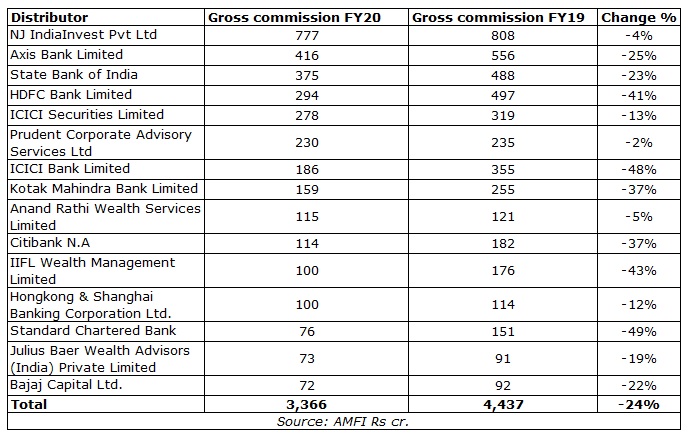

An analysis of the gross earnings of the top 15 distributors shows that their commissions dropped by 24% from Rs 4,437 crore in FY19 to Rs 3,366 crore.

Stock markets across the world were hit due to the Corona pandemic and India was no exception. After reaching a peak of 41,253 in December 2020, Sensex tumbled to 29,468 in March 2020.

“There are a couple of reasons for this decline in earnings. The commission payouts drops as fund size increases. Most of these banks sell large funds. Also, there has been a drop in mutual fund sales last fiscal. Further, banks are focusing more on Portfolio Management Services (PMS) distribution to diversify their revenue sources,” said the CEO of a foreign fund house.

Open-ended equity schemes with assets under management of up to Rs 500 crore are allowed to charge 2.25 % total expense ratio, 1.50% up to Rs 10,000 crore which reduces further as the fund size grows. The industry has also adopted a full trail model. Fund houses have passed on the squeeze in their margins to distributors.

NJ India, the largest MF distributor, saw its gross earnings drop by -4% from Rs 808 crore in FY19 to Rs 777 crore in FY20. Among the top 15 distributors, Standard Chartered saw the biggest drop. Its gross earnings from mutual funds fell from Rs 151 crore to Rs 76 crore during the same period. Similarly, the earnings of ICICI Bank from mutual fund distribution fell from Rs 355 crore to Rs 186 crore during the same period.

A total of 852 distributors received Rs 6,135 crore gross commission from mutual fund houses in FY20, down by 23% from Rs 7,948 crore received by 1,073 top distributors in FY19.

Earnings of the top 15 mutual fund distributors