Changes in how investors and financial advisers collaborate, at first caused by Covid-19, are likely to remain long after the pandemic, according to a new survey from Broadridge Financial Solutions, Inc., a global fintech leader. Though the survey was conducted in United States and Canada, the findings are relevant for advisers in India.

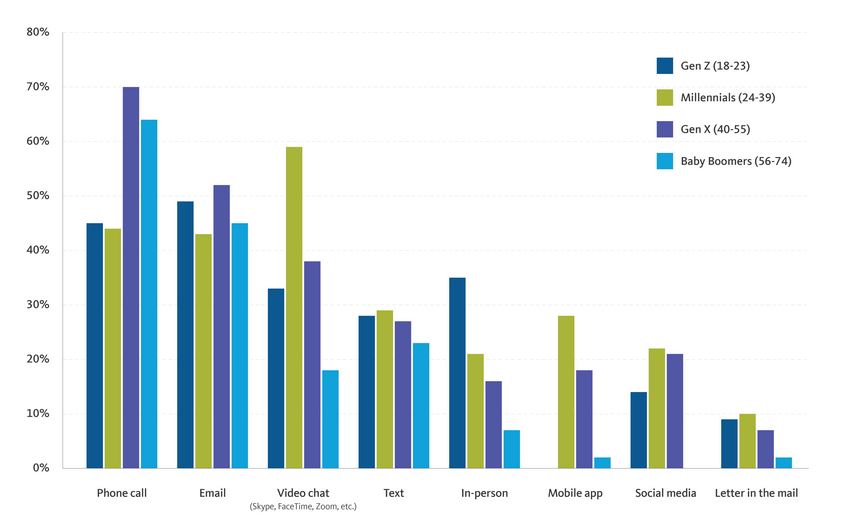

Over half (57%) of investors surveyed said communications with their adviser had changed in some way in light of new stay-at-home mandates. Sixty-two percent of those who reported a change in mode of communication said they would entirely or partially maintain their new methods after the pandemic ends. Fifty-eight percent cited phone calls and 46% cited emails as new ways that they communicated with their adviser during the pandemic. More than a third (36%) used video chat, even though only 9% prefer the method above all others. Millennial investors were most likely to use video chat with their adviser (59%).

Personalized and Individualized Adviser Communications

When asked what they like to see in communications from their adviser, respondents preferred information that is individualized to them:

- 44% - comprehensive view of their accounts

- 32% - money saving tips tailored for them

- 32% - ideas for new investment vehicles that could work for them

- 29% - personalized analysis of investing habits

Social Media Remains Key to Connecting with Younger Clients

An overwhelming majority of Gen Z (86%) and Millennials (87%) said they are comfortable having an adviser follow them on social media to offer a more customized experience. Meanwhile, only 60% of Gen X and 20% of Baby Boomers are comfortable.

- Gen X: Birth years around 1965 to 1980

- Millennials: Birth years around 1981 to 1996

- Gen Z: Birth years around 1990s to 2010s

Facebook is the top social media platform where Millennials (66%), Gen X (46%) and Baby Boomers (15%) would feel comfortable with their FA following them, while Gen Z is most comfortable with advisers following them on Instagram (53%). Fifty percent of Millennials are also comfortable with advisers following them on Instagram.

Millennials (87%) and Gen Z (86%) are most likely to be receptive to reading adviser communications on social media as opposed to Gen X (59%) and Baby Boomers (18%).

Advisers Missing Key Family Relationships

Despite 44% of respondents stating that they discovered their financial adviser through a personal referral, nearly half (44%) reported that their adviser has not communicated with their spouse, partner, children, grandchildren or heir.