The RIA guidelines issued in July 2020 have brought clarity for mutual fund distributors (MFDs) and Registered Investment Advisers (RIAs). All intermediaries in the mutual fund space will, therefore, have to understand its implications and comply accordingly.

My objective is to help RIAs and MFDs understand these regulations and choose the right model depending on the services offered by them.

An MFD was allowed to distribute and advise both under the same license. When RIA regulation was announced, it created a lot of confusion for MFDs.

The RIA regulations laid down the framework for intermediaries who provide advice to clients, act in a fiduciary capacity and address the conflict of interest.

Let us look at some of the important terms and their definitions:

Investment advice: Any advice given to clients relating to investing, purchasing, selling in securities or investment products, written or oral and shall include financial planning.

Financial planning: Financial Planning shall include analysis of clients’ financial situation, goals, developing and recommending strategies to realize such goals.

Investment Adviser: Investment Adviser means any person, who for consideration, is engaged in the business of providing investment advice to clients.

My view: If you are advising clients or doing their financial planning or goal planning, you are considered as an investment adviser and you need to register as RIA.

Let us look at other parameters which an IA has to follow:

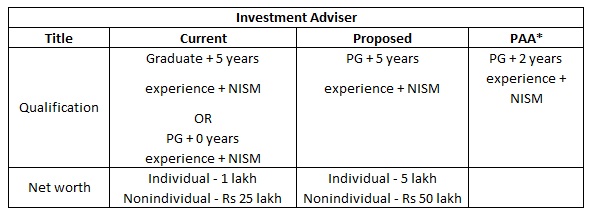

Eligibility Criteria

*PAA (Person associated with investment advice). Anybody who faces clients and provides advice under whatever name you call it.

My view: An IA will be able to give a lot of confidence and comfort to both investors and regulators, demonstrate expertise and capabilities to conduct duties in line with what the regulation and expectations of clients.

Client level segregation of advisory and distribution activities

Individual RIAs

- Wherever applicable advice direct version (zero commission) products

- Wherever direct version is not available (disclose the remuneration)

- Cannot be a distributor (ARN holder) and hence cannot offer distribution services

- Cannot offer advisory services to a client who is receiving distribution services from any family member of IA (family of IA includes individual, spouse, children, parents)

Non-Individual RIAs including partnerships

- Can offer both advisory and distribution services

- They can have both RIA and ARN licenses but need to have clear segregation between advisory and distribution activities

- A client can either be an advisory client or distribution services client

- “Family of a client” may constitute individual, dependent spouse, dependent children, dependent parents (PAN to be the controlling record for identification)

*Distribution Services – MFD or Corporate RIA selling regular mutual funds and getting commissions.

My view: The client will have to be given one service at a time. You cannot offer both services under any arrangement or any business model to the same client. It actually makes logical sense to do this as you can choose at a client level what kind of arrangement you need to do with that client.

**Definition of Conflict of Interest – A CA auditing his own firm

A conflict of interest in business normally refers to a situation in which an individual's personal interest conflicts with professional interests.

Implementation Services

Implementation/execution can be offered by IAs but only in direct schemes wherever applicable without any commercial consideration. Clients to be given a choice to choose their implementation partner.

My view: Implementation services are allowed for RIAs so that feeds can be received from RTAs or exchanges and RIAs can monitor the portfolios on an ongoing basis.

Advisory Fee

There are 2 mechanisms under which advisory fees is allowed & can be charged

Assets under advice (AUA)

- The aggregate net asset value of securities for which the IA has rendered advice

- Any schemes where commissions are already been paid has to be deducted

- The maximum fee that can be charged under this mechanism is 2.5% per annum per family

Fixed fee

- Maximum fixed fee: Rs 1.25 lakh per annum per family

- 2 quarters advance fee can be charged

- Profit-sharing cannot be charged as the regulator looks at it like a PMS structure.

Collection of advisory fees

- Can be done in any mode as long as funds are traceable

- No cash payments allowed or payment gateways to be used for collection of advisory fees

- Advisory fee charged should be fair and reasonable

My view: % of AUA is definitely a win-win model, IA make more fees if the portfolio goes up and less fees if the portfolio goes down. So if an IA has to make more money the only thing he has to do is to focus on increasing the portfolio. Globally we have seen this number in the range of 75 bps to 100 bps.

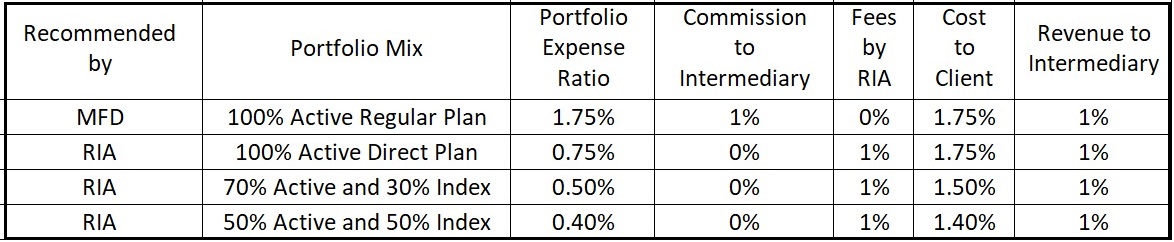

IAs would like to keep the cost to the client similar or lower to what the client otherwise would have paid in regular plans. (See the table below). I have taken actual schemes and their actual TER for illustration purpose.

Observations:

- IAs can look at keeping the cost to client and revenue to intermediary similar to what an MFD model is.

- IAs can reduce the cost to client by introducing passive funds and by still maintaining their revenues.

- New scheme categorization + comparison of scheme with TRI will put pressure on fund manager to show alpha.

- Passive funds and ETF’s will become more popular over time.

Risk Profiling, Suitability, Rationale, Disclosure and Maintenance of records:

- IA to do proper risk profiling to understand client's risk appetite, risk tolerance levels, and gather all information so that IA can give advice in line with the client’s risk profile. Risk Profile should be shared with the client after the assessment is done and should be reviewed yearly to see if the clients risk profile has changed or it is the same.

- Any recommendation is given to a client to purchase of a particular financial product, such recommendation is appropriate, has a documented process and based upon a reasonable assessment that the structure and risk-reward profile of the product is consistent with clients experience, knowledge, investment objectives, risk appetite and capacity for absorbing loss.

- Every investment advice should have a documented rational.

- Disclose: All about itself, practice including terms of advice, conflict of interest, remunerations, features of the schemes, products, warnings, risks, disclaimers etc.

- Maintain: All of above points physically or digitally including meetings logs, MoM, actions, tasks, for a period of 5 years.

My view: If we advise client knowing their personality, how much risk she can take, the objective or goal, how will she react in volatile times, do proper suitability check, record all meeting discussions and use a proper process in client management then I am sure that her experience in capital markets is going to be far better. The onus is not just on RIA for the goal to be achieved; now the client is equally involved and responsible for the success of the investment journey and defined goals.

Terms & Conditions of IA services, Compliance and Audit Requirements:

- There are 22 clauses mentioned in consultation 4 which has to become a part of IA minimum terms and conditions as a part of the document which needs to be shared with the client and get his consent that he has read and understood the same and he accepts the terms of IA. No advice to be given or fees to charged until this is received from the client.

- Audit of the IA to be completed within 6 months from the end of the financial year.

- Findings and actions taken to be reported to SEBI within 1 month from the date of completion of the audit.

Code of conduct for IAs – Refer to Page 24 and 25 (3rd schedule) in original RIA regulations.

In the next article, Aakash will take a deep dive into the mutual fund distributor regulation.