Investors seem to be favouring large cap firms, especially in the pandemic hit era, during which stable firms are expected to weather the downturn better.

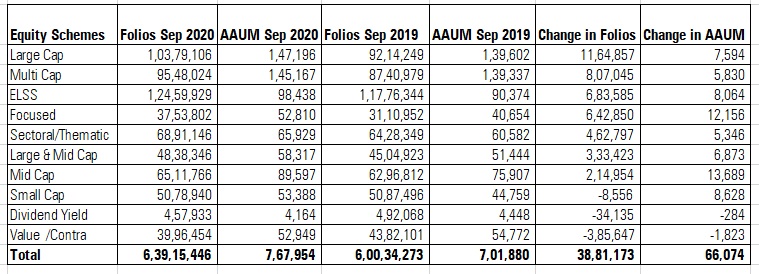

This is evident from the 11.64 lakh growth in folios or investor accounts in the large cap space in the last one year, the highest among all categories of equity funds. Investor accounts in large cap funds jumped from 92.14 lakh in September 2019 to reach 1.03 crore in September 2020. During the same period, large cap assets under management increased by Rs 7,594 crore.

As of September 2020, large cap is the largest category among equity mutual funds category with assets under management worth Rs 1.47 lakh crore, closely followed by multi caps which manage Rs 1.45 lakh crore.

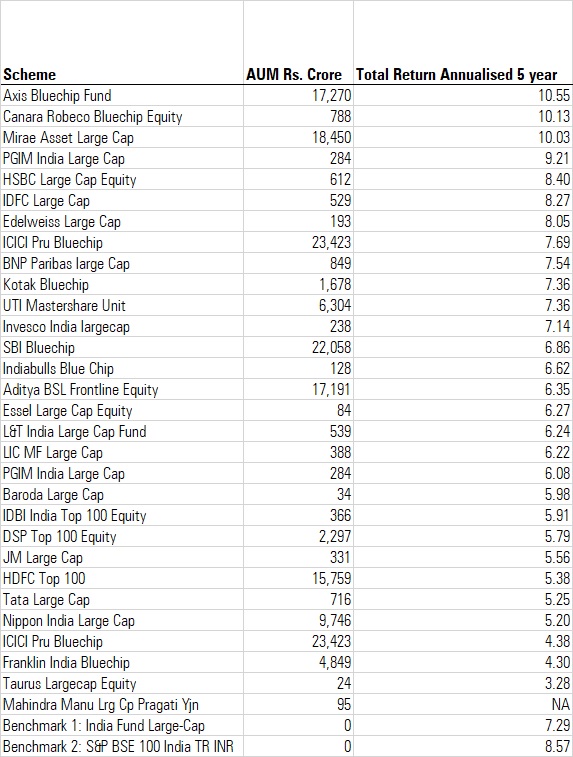

Performance of large cap funds

While large caps are getting decent inflows, the category has been finding it difficult to outperform the benchmark lately. As we can see from the above table, only four funds have been able to outperform the BSE 100 index over a five year period. (Data source: Morningstar Direct)

“From 2018 to 2020, large caps have significantly outperformed mid caps. Thus, large cap fund investors have had a better experience. People are finding comfort in large caps. Multi cap funds that have a tilt towards large cap have received good inflows. In the first six months, banking funds added money followed by pharma funds. Sector funds focused on technology are getting inflows lately. The last one-year rally was very narrow. Hence, focused funds which had the right stocks performed very well,” observes Vinod Jain of Jain Investment.

In the last two years, BSE 100 is up 7.33% while BSE Mid Cap and BSE Small Cap Index have trailed at 3% and 5% respectively.

Growth in folios and AAUM in one year

AAUM in Rs. crore.

Multi cap funds also generated a lot of interest among the investor community, with funds having large cap bias receiving good flows. The folio base in multi cap funds increased by 8.07 lakh, which was the second-largest growth in folios after large cap funds.

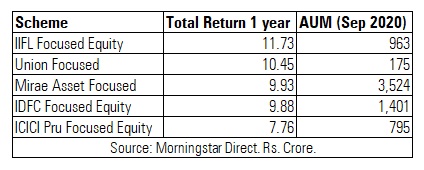

Focused funds gaining traction

The investor base in focused funds increased by 6.42 lakh while the AUM increased by Rs 12,156 crore in one year. There are 24 focused funds in the industry which collectively manage assets worth Rs 52,810 crore. Focused funds are not permitted to have more than 30 stocks in their portfolio. This category is gaining traction lately. The largest fund in this category is Axis Focused 25 Fund with asset size of Rs 11,455 crore, followed by SBI Focused Equity Fund with AUM of Rs 10,114 crore, and Franklin India Focused Fund at third position with AUM of Rs 6,442 crore.

Funds that have delivered the highest return over 1 year

Healthcare and technology funds are shining

Sectoral/thematic funds also saw good traction as this category recorded the fifth highest growth in folios over one year with an addition of 4.62 lakh investor accounts in one year. Three themes that benefitted the most from the Covid-19 pandemic are pharma, technology and gold. Pharma funds topped the charts with category average returns of 55% in one year, followed by technology sector funds which yielded 46% return. Gold delivered 30% during the same period.

The three categories that saw a dip in investor accounts were small cap, dividend yield funds and value funds. Small cap funds have delivered 13% (category average) return over one year.

The laggards

The category average returns of value funds stood at just 1%. Value/contra funds are being shunned by investors as the category saw a depletion of 3.85 lakh investor accounts in one year. Even dividend yield funds performance was nothing to write home about as the category generated 2.81% return over one year. Dividend yield funds saw a 34,135 dip in folios in one year.

Other sectors that seem to be out of favour are financial services and infrastructure. Financial services sector funds category average returns stood at - 16% while infrastructure sector funds clocked - 10% over a one year period.

Overall, the industry added 38.81 lakh folios in one year across all categories of equity funds, with Rs 66,074 crore growth in assets under management.