Creating and managing one’s investment portfolio requires decisions on which asset classes to invest in, how to invest, the timing of entry and exit and finally, reviewing and rebalancing the portfolio. These decisions have to be made based on the analysis of the market conditions. However, sometimes, behavioural biases come in the way of your client’s decision-making, leading to less-than-optimal choices being made.

There are 7 common behavioural biases faced by your clients:

- Optimism or Confidence Bias: Investors believe they can outperform the market based on past success. For instance, sticking to a top-performing sector or theme.

- Familiarity Bias: The bias leads investors to choose stocks, sectors and asset classes they are comfortable with. For instance, investors who have invested in Debt funds might shy from investing in riskier asset classes such as equity mutual funds.

- Anchoring Bias: This form of bias leads to investors holding on to some information that may no longer be relevant. For instance, suppose an investor sees that mutual fund ABC has outperformed the benchmark over a 1-year timeframe and decides to invest their money in it despite new information that the fund has failed to beat the market consistently.

- Loss Aversion Bias: Studies indicate that the pain of loss is twice as strong as the pleasure they left at a gain of a similar magnitude. Holding on to fixed deposits, avoiding riskier asset classes like equity when there is a lot of information and discussions on market volatility are manifestations of this bias.

- Herd Mentality Bias: Often, investors are compelled to make hasty redemption decisions due to passing emotions or advice from non-professionals such as friends and relatives. This might be the reason for oversubscription in IPOs or popularity regarding NFOs against existing mutual funds with a long-standing track record.

- Recency Bias: The impact of recent events on decision-making can be powerful. The recent experience overrides analysis in decision making. For instance, investors might prefer safer assets during a bear market or a financial crisis.

- Choice Paralysis Bias: The availability of too many options for investment can lead to a situation of not wanting to evaluate and make the decisions. For instance, there are over 350+equity mutual funds in the market, thereby leading to choice paralysis and inaction from investors.

So how do you help your clients overcome these behavioural biases?

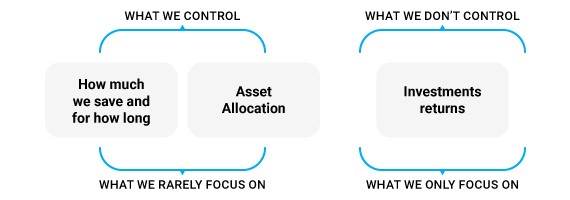

Today’s economic environment is very unpredictable. Thus, when it comes to investing, instead of obsessing on news and events outside one’s control, it’s important to guide your investors to manage what’s within their control.

Here are five ways how you can help your clients/investors overcome behavioural biases:

- Time in the market vs. timing the market

Investors need to be reminded that investing is not about beating the market or anybody else; it is about building wealth with patience and perseverance, keeping their financial goals firmly in check. The longer one stays invested, the better one can benefit from compounding their mutual fund returns. As a general guideline, it is best not to redeem from equity mutual funds unless one is nearing their financial goals or has a genuine need for money.

- Selecting mutual fund based on consistent track record

When selecting a mutual fund, one must consider the peer comparison along with the benchmark over a longer period (across different market cycles) and also assess the funds’ risk in tandem to their risk profile.

- Start an SIP

Starting an SIP (systematic investment plan) frees your investors from the need to time the market, as it brings in rupee cost averaging, which essentially means buying low during a bullish market and high during a recession. This would average the cost of purchase and thus overcome investor inertia and inaction arising out of the right time to enter and exit the market.

- Keep aside safe money

Make sure your investors have 12-24 months of expenses set aside as emergency money in a savings account and liquid funds. This could prepare them for unforeseen events such as natural calamities, sudden loss of income, job loss, medical expenses, or unplanned expenses.

- Asset Allocation

Investors should resort to prudent asset allocation to free themselves from behavioural biases and thus resist the need to time the market. The risk and return in various asset classes (equity, debt, gold, etc) are driven by different economic conditions.

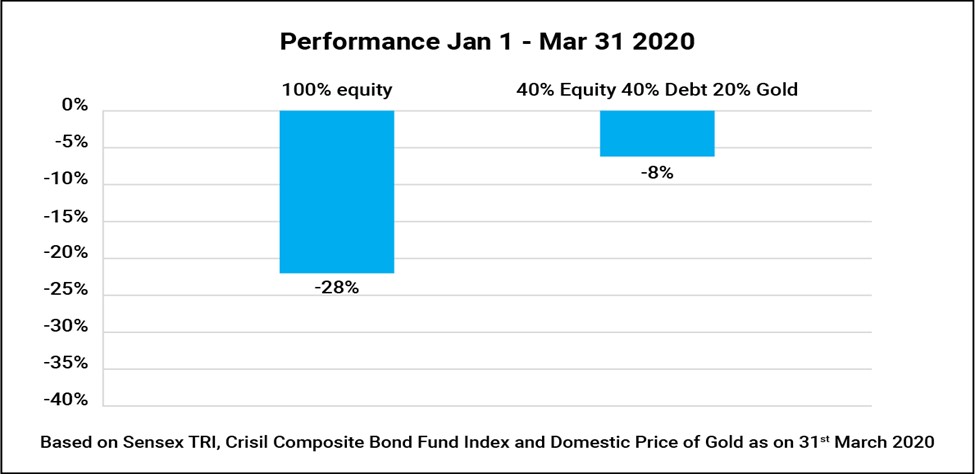

For instance, the year 2020 was a reminder of the virtues of asset allocation. An investor who would have saved 100% in equities would have seen their portfolio value reduce for the 3 months ending March 2020, at the peak of the pandemic. On the other hand, during the same period gold prices went up. Thus, a person who would have diversified in Equity, Debt and Gold would have minimized downside risks and earned better risk-adjusted returns than an investor who invested only in equities.

The risk in a portfolio can be reduced by bringing together asset classes whose performance are not affected by the same factors or in the same way. Instead of stock selection and timing the market, the risk in a portfolio can be reduced by bringing together asset classes with low correlation.

After setting aside an emergency corpus, you can suggest your investors to consider investing 20% of their portfolio to the risk-reducing and portfolio diversifying asset of Gold. The balance of 80% can be invested in a diversified equity portfolio that has the potential to help them reach their financial goals over the long term.

Investing strategies such as value investing helps to avoid the effect of herd mentality. While Equity Fund of Funds can help overcome choice paralysis as it invests in carefully selected equity mutual funds of other schemes with a proven track record. Investors with optimism bias can channel their optimism to an and ESG Equity fund. ESG stands for the Environment, Society, and Governance factors that play a significant role in investment processes and decision-making. It offers a framework for analyzing companies and assessing how well they compare to their peers in terms of performance against these metrics.

Investors who exhibit loss aversion bias can invest in a multi-asset fund of funds that follows a regular rebalancing approach within each asset class of equity, debt and gold, thereby giving investors the potential to generate risk-adjusted returns through diversification of investments.

Predicting which asset class or mutual fund is going to be the next best performer is not easy. But diversifying and having an asset allocation strategy is in one’s control. Asset allocation can reduce portfolio volatility and smooth out the investment journey.