When interest rates are rising, most analysts are advising investors to move to Floating Rate funds. Why not Dynamic bond funds? They have the mandate to be duration-agnostic as well as instrument-agnostic. So why should they not be the one stop solution for a retail investor as they are free to move across maturities or types of instruments? What are your views?

Floating rate funds are mandated to invest at least 65% of their total assets in floating-rate instruments. These funds benefit from a rising interest rate scenario as the coupons (interest rate) on such instruments are adjusted/reset upwards when interest rates move north.

Given the dearth of floating-rate instruments in the Indian debt markets, these funds typically invest in fixed-coupon bonds and use derivative instruments like Interest rate swaps to convert the fixed-rate receivables into floating-rate thereby benefiting from higher rates when interest rates rise.

Beginning 2019, the RBI cut the policy rate sharply (250 bps) and announced a slew of measures to support the slowdown in the economy which was later exacerbated by the COVID-19 pandemic. These measures along with abundant liquidity in the banking system resulted in yields falling across the yield curve, particularly at the shorter end leading to a steepening of the yield curve.

However, in recent times the yield curve has seen an upward shift and has also flattened somewhat following a sharper rise in yields at the shorter end amid measures by the RBI such as repo rate hike, CRR increase, lowering of systemic liquidity, etc. in response to concerns over inflation and monetary tightening by global central banks. Hence, given the expectations of rising interest rates, these funds are suitable as they benefit from a rising rate cycle.

How do Floating Rate Funds compare with Dynamic Bond Funds?

Dynamic bond funds by mandate can move freely across the duration spectrum and are not required to maintain their duration in a target range as do some funds belonging to other categories. Also, they have no restriction on the credit quality that they need to maintain.

Depending on the macroeconomic assessment of the manager, he may either allocate the bulk of the portfolio to either the shorter end of the yield curve or the longer end. He is also free to invest in very safe instruments such as sovereign instruments like G-secs, T-bills or take exposure to lower-rated corporate bonds based on his assessment of the risk-reward on offer. Also, the manager needs to be skilled in security selection and in assessing the expectations around various segments of the yield curve. Hence, given the high level of flexibility that managers of such funds have, such funds do entail a high amount of risk as the performance is dependent on the fund manager’s calls (on interest rates and credit) playing out.

Note that if short-term rates rise more than long-term yields, a portfolio maintaining a lower duration could experience a greater loss compared to one maintaining a higher duration, since the loss depends on the quantum of rise in interest rates and the duration.

When there is an upward shift in interest rates, rates could rise both at the shorter end as well as at the longer end of the yield curve, as they have recently. Hence, in such cases, the fund manager despite maintaining lower duration (which is typically associated with lower risk) could face losses. On the other hand, given floating rate funds benefit from the upward move in interest rates (as discussed at the start), these funds are likely to do well than dynamic bond funds.

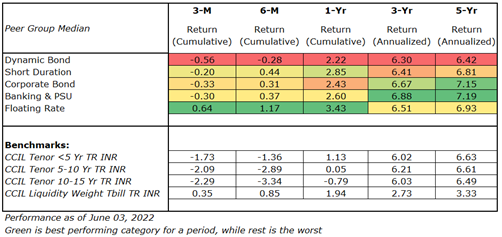

Over the past six months wherein shorter-term yields have risen sharply compared to the longer-term yields, floating rate funds have fared better than the Dynamic bond fund category (as of June 03, 2022), and have also outperformed shorter-duration categories such as banking & PSU debt fund, corporate bond fund and short-duration funds. However, dynamic bond funds can form a part of the satellite (non-core) portion of the portfolio if your investment horizon is reasonably long (5+ years) as these funds can be expected to do well over a complete interest rate cycle.

(click on image to enlarge)

ASK MORNINGSTAR archives

Articles authored by MOHASIN ATHANIKAR

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries relating to mutual funds, portfolio planning and personal finance. While we provide broad guidelines, we suggest you consult a financial adviser before making investment decisions.