Credit Risk Funds are doing exceptionally well. That does not mean you should be parting with your money. Without much ado, let me tell you why.

First, a little bit of history.

The 2015 Amtek Auto debacle was brushed aside as an aberration of sorts.

In 2018, IL&FS was the burning issue. In June, IL&FS Transportation Networks delayed repayment of Rs 450 crore of inter-corporate deposits from SIDBI. In August, IL&FS Financial Services defaulted on its Commercial Paper (CP) but honoured it a few days later. In September, the defaults begin to gather in momentum.

In 2019, the bonds of Dewan Housing Finance Corp Ltd (DHFL) got downgraded as the company was grappling with a liquidity crisis amid allegations of financial irregularities.

Downgrades and defaults left some of the fixed-income funds in a serious liquidity crunch as redemptions in certain categories exploded. One of the outcomes of such a scenario is that fund managers are forced to sell to meet redemption pressures. Naturally this will hit funds with smaller corpuses even more. They will have to exit the “good” (since that is liquid and there will be buyers) to pay for the sins of the “bad”. Consequently, the paper in question will corner a greater portion of the corpus as was originally intended.

Franklin Templeton’s decision to shut down six debt schemes in April 2020 pulled the carpet from under everyone’s feet. And of course, the pandemic hit with a vengeance.

The Credit Risk Fund category witnessed 21 consecutive months of net outflows from April 2019 till December 2020 to the tune of Rs 56,317 crore. Some of the worst (calendar year) performers during that period were BOI AXA Credit Risk (2019: -45%), UTI Credit Risk in (2020: -27%), Sundaram S/T Credit Risk (2019: -5.49%), and DSP Credit Risk (2018: -2%).

Suddenly, but unsurprisingly, investors forgot the double-digit returns delivered by Credit Risk Funds in 2014, 2015 and 2016.

The point I am making is that these funds are risky. They can deliver admirably (and they have), but they can cause you grief. And do you honestly want that from your debt allocation?

What are Credit Risk Funds?

Credit Risk Funds are debt funds that invest at least 65% of their portfolio in lower-rated companies (AA and below). Why would they take this risk? Because of the potential for a higher return. The borrower pays a higher interest rate to compensate for the lower credit rating.

How must they be positioned in your portfolio?

You can allocate a maximum 20% of your debt portfolio to being a bit enterprising (though some would call it reckless, as the purpose of debt is to cushion against the volatility of equity). Since debt is the “safe part” of the portfolio, I specified a maximum limit of 20%.

In this 20% bucket, you could invest in credit funds, gilt funds, or dynamic bond funds.

Gilt funds have no credit risk or risk of default. Their risk is interest rate movements. So you need to get in at the right time based on where you see interest rates headed.

With credit risk funds, the risk is one of default and getting your capital wiped out. Tread cautiously and check the quality of the portfolio.

Dynamic bond funds invest across durations and even take credit risks. They have no restriction on duration or credit quality. Get well versed with the fund manager’s strategy and quality of the portfolio.

How do you check the quality of the portfolio?

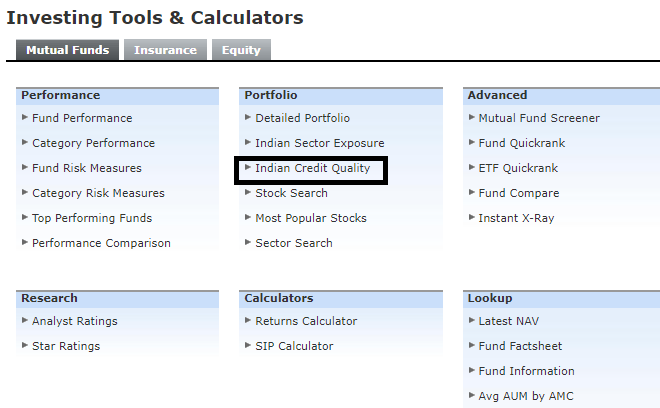

Go to the Tools page and click on Indian credit quality. Enter the name of the respective fund and you will be able to get a snapshot. You can enter more than one fund and do a comparison too.

Which Credit Risk Funds should you consider?

Now if you decide to allocate a small portion of your debt portfolio to a Credit Risk Fund, here's help. Morningstar’s analysts have looked at 5 credit risk funds and analysed them in detail.

- HDFC Credit Risk Debt Fund

- Nippon India Credit Risk Fund

- SBI Credit Risk Fund

- Kotak Credit Risk Fund

- ICICI Prudential Credit Risk Fund

You can see the detailed analysis of each of the above in Our analysts' verdict on 5 Credit Risk funds

Where do I invest?

I would like to come clean with you here.

In my personal investment portfolio, I have allocated 40% to debt. This includes a bank deposit, Public Provident Fund (PPF), Employee Provident Fund (EPF), a non-convertible debenture (NCD), a liquid fund and a short-term debt fund. I have not taken any risk with my debt allocation. I did once upon a time, and I regretted it. Because the nuance and understanding of debt is not simple. I have discussed this in much more detail in My biggest investment goof-ups.

Larissa Fernand is an Investment Specialist and Senior Editor for Morningstar India. You can follow her on Twitter