A growing number of private equity-backed companies seeking bankruptcy protection could be a sign that more of these businesses are struggling to service their debt.

Even after undertaking extensive efforts to manage portfolio company liabilities, some sponsors will still see businesses fail; they will need to help their favoured investments survive as the credit cycle turns against overextended borrowers in their portfolios. PE firms are equipped with ample dry powder to support their portfolio companies. However, as the market downturn persists, they are becoming more selective about which of their portfolio companies to back, pumping liquidity only into their most promising businesses.

A mix of adverse conditions created a perfect storm that trampled the balance sheets of over-leveraged companies that are no longer able to service their debt, said Daniel Ehrmann, the head of restructuring at King Street Capital Management, a hedge fund manager that specializes in trading distressed assets.

More sponsor-backed companies are cracking under the strain of a spike in corporate borrowing costs due to the increase in interest rates—from nearly zero in March 2022 to a range of 5% to 5.25% in May 2023—persistent inflation pressures, and lingering supply disruptions, Ehrmann added.

Meanwhile, lenders, in particular banks, are tightening their belts and becoming more stingy with credit, leaving many companies that might otherwise be qualified for additional borrowings to face heightened scrutiny.

"Banks are all terrified," said Michael Sweet, a partner at Fox Rothschild. "What happened with Silicon Valley Bank, Signature Bank and First Republic created a shudder through the financial markets in the United States."

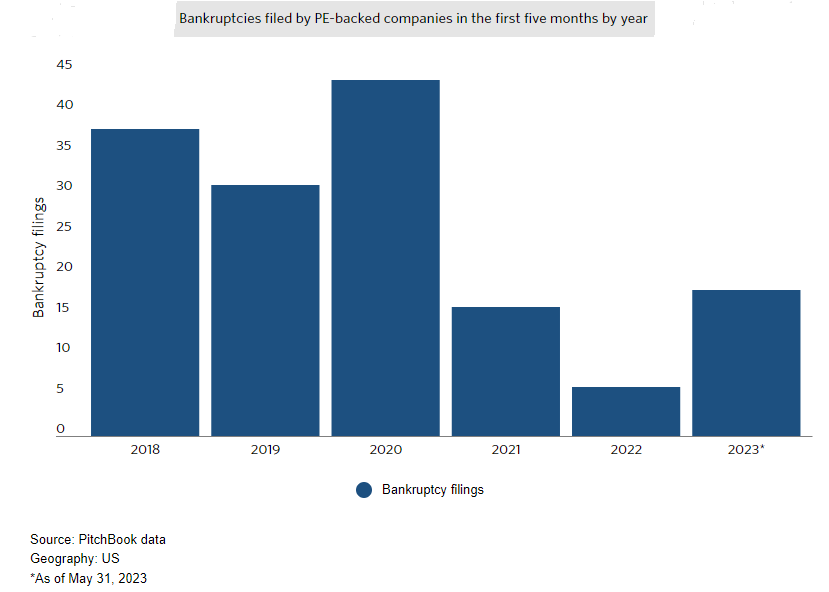

PitchBook data shows at least 18 PE-backed companies filed for bankruptcy in the U.S. during the first five months of 2023—the highest number since 2020. Some prominent names:

- KKR-owned hospital staffing company Envision Healthcare (Envision listed $7.7 billion in outstanding debt)

- Advent International-backed mattress-maker Serta Simmons

- Vice Media that counted TPG and Sixth Street among its backers

- Aircraft parts distributor Incora, a portfolio company of Platinum Equity, filed for Chapter 11 bankruptcy protection this month to restructure $3.14 billion in debt

- GenesisCare, a Sydney-headquartered healthcare provider backed by KKR, recently entered bankruptcy with more than $1.7 billion in debt.

The above is an excerpt from a PitchBook news report.