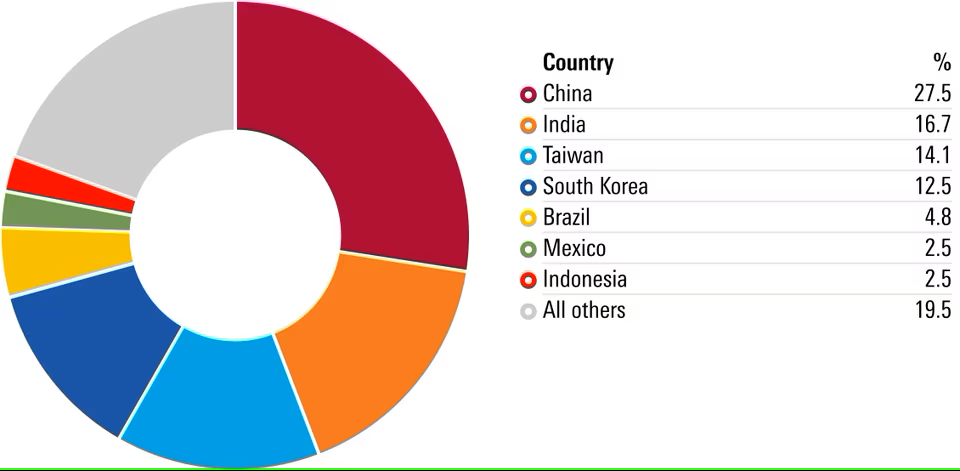

Roughly one third of the Morningstar Emerging Markets Index is made up of Chinese stocks on a market-cap-weighted basis. Other index heavyweights include India (16.7% of the index) and Taiwan (14.1%).

“Emerging-markets indexes invest heavily in China, so investing broadly in the index comes with more geopolitical risk,” says Doug McGraw, portfolio manager at Morningstar Investment Management. “Major companies, and the market as a whole, have at times been constrained by government policies in order to support employment or promote what’s seen as healthy for the country.” McGraw mentions, for example, that the Chinese government has restricted the ability of video game companies to market their products while limiting the number of new games released.

Four of the 10 largest stocks in the emerging-markets index are Chinese companies: social-media giant Tencent, with a market capitalization of $387 billion as of May 31, 2023; e-commerce giant Alibaba, with a current market cap of $204 billion; food-delivery services company Meituan, with a market cap of $87.9 billion; and Beijing-based China Construction Bank, with $162.5 billion in market cap.

At the same time, as McGraw points out, many of the largest emerging-markets companies generate substantial revenue from outside their home countries. For example, Taiwan Semiconductor - the largest company in the emerging-markets index, with a market cap of $470.9 billion—generates 66% of its total revenue from the U.S. “The economic exposure goes beyond Taiwan,” he says, “It’s people all over the world buying electronic devices and computers.”

Roughly 10% of total emerging-markets revenue exposure comes from the U.S., by McGraw’s measures. “It’s important to look under the hood at the individual companies within the index to understand what kinds of risks and revenues you’re really exposed to.”

Emerging-Markets Country Risk Exposure