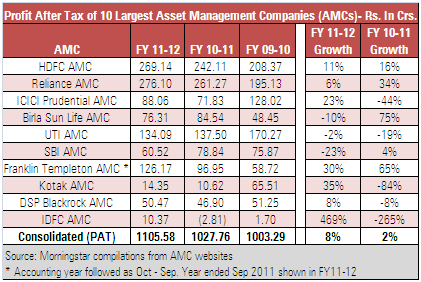

The profitability growth of fund companies was a mixed-bag in FY11-12, but largely improved during the fiscal year. The growth in consolidated Profit after Tax (PAT) of the ten largest asset management companies (AMCs), in terms of assets, was 8% in FY11-12, after a flattish growth of 2% in FY10-11. In FY09-10, the consolidated PAT growth of the ten largest AMCs was a strong 62%, due to lower base effect, helped by the financial crisis and the resultant slowdown seen in FY08-09. None of the ten largest AMCs posted losses during the year. IDFC AMC, which had registered a loss in FY10-11, closed FY11-12 with a PAT of Rs. 10.37 crores. The ten largest AMCs accounted for about 77% of the fund industry assets at the end of 2012.

Reliance AMC retained the spot as the most profitable fund company in India, as it recorded a PAT of Rs. 276.10 crores during FY11-12. However, its PAT growth stood at a modest 6% in FY11-12, compared to a PAT growth of 34% registered in FY10-11. HDFC AMC was the second most profitable fund company in India, and saw its PAT grow by 11% in FY11-12.

Amongst the ten largest AMCs, SBI AMC and Birla Sun Life AMC registered a negative PAT growth during FY11-12. IDFC AMC which has emerged among the ten largest AMCs (in terms of assets) at the end of 2012, closed FY11-12 with a PAT of Rs. 10.37 crores, compared to a loss of Rs. 2.81 crores posted in FY10-11. Other large fund companies like Kotak and Franklin Templeton registered a healthy growth in profits in FY11-12.

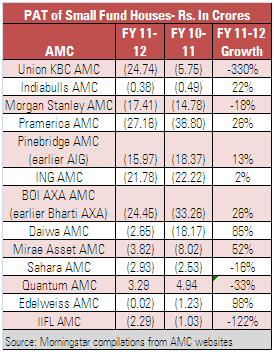

Meanwhile, almost all the small fund houses continued to dabble in losses in FY11-12, but the magnitude of losses did reduce in a number of cases during the fiscal year. This indicates that the financial situation is grimmer within the smaller fund companies. Quantum AMC was the only fund house (of the smallest ten) which actually managed to post a profit in FY11-12; although its profits fell during the year.