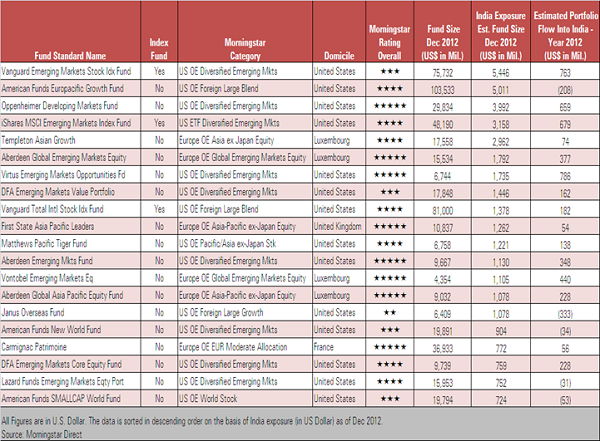

As per data from Indian market regulator SEBI, foreign institutional investors (FIIs) pumped in more than $24 billion into Indian stocks during the year 2012.

Quantitative easing around the world, and various policy reforms by the Indian government announced in the second half of the year led to large inflows into Indian stocks.

This is the second highest FII inflow registered in a calendar year into the Indian stock markets. The highest FII inflow was recorded in calendar year 2010 (of more than $29 billion). (See image 1 below.)

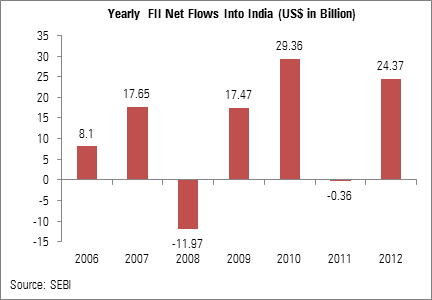

However, data from Morningstar shows that India focused offshore funds and ETFs registered outflows during the year. The magnitude of outflows did drop, compared to the previous year.

These funds and ETFs had registered a cumulative net outflow of $1.8 billion during the year 2012, compared to a net outflow of $5.4 billion registered during the year 2011.

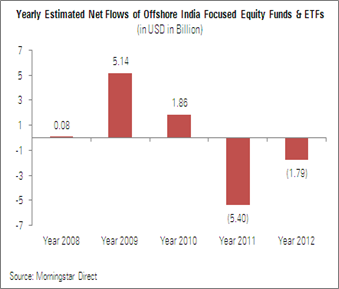

The volatility in the rupee, coupled with macroeconomic concerns of a slowdown and ballooning deficit weighed on sentiments, and resulted in outflows for most part of 2012 from the India focused offshore funds. Despite the outflows, the assets of all India focused offshore India funds & ETFs rose by 19% during the year to around $37 billion, mainly due to market movement, as the Indian stock market rebounded strongly.

Yearly Estimated Net Flows (ENF) and Assets of Offshore India Focused Equity Funds & ETFs

Emerging Market Funds and Asia ex Japan Funds were big contributors of inflows into India

So if the FII money if not coming in via the route of India focused offshore funds and ETFs, then the question that arises is where the foreign money into India coming from? A deeper look into our database of international mutual funds helps to provide some clarification. There are a number of funds which have partial allocation to India in their portfolios. These primarily include emerging market funds, Asia-Ex Japan funds, BRIC funds and other global equity funds. A large part of the inflows into the Indian stock markets also comes in via the route of such funds having partial allocation to India in their portfolios. A number of these funds have large assets under management, so inflows into these funds can translate into substantial inflows into Indian stocks.

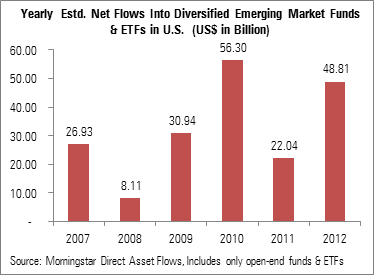

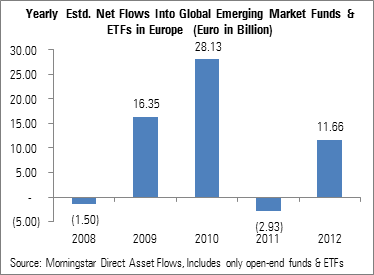

One big contributor of flows into India in 2012 have been emerging market stock funds. These funds have a decent allocation to India in their portfolios, and have registered huge inflows from investors during 2012. Concerns in the U.S. and in the Eurozone, higher growth prospects in emerging countries, and quantitative easing around the world has prompted investors to pour money into emerging market funds. Meanwhile domestic stock funds in the U.S. recorded huge redemptions, with the cumulative outflows for these funds in 2012 expected to surpass the record outflows registered in 2008. As per Morningstar Asset Flows data, U.S. Diversified Emerging Markets Funds and ETFs together registered the second highest ever annual inflows of almost $49 billion during the year 2012, since when data is available in the Morningstar Asset Flows database. The highest inflow into this category was registered during the year 2010 (of a record $56 billion). Similarly emerging market funds and ETFs (available for sale) in Europe also registered good inflows during 2012. Funds and ETFs belonging to the Morningstar Global Emerging Markets Equity category in Europe registered a net inflow of €11.66 billion during the year (through November 2012). In 2011, these funds had registered a net outflow of almost €3 billion.

Also, allocation to India increased in portfolios of several emerging market funds during the year 2012. This could have been due to market movement (with the Indian markets performing relatively well in 2012), and also with some active fund managers increasing allocation to India in their portfolios. This in turn would have also contributed to increased inflows into India. For example, the largest emerging market fund viz. Vanguard Emerging Markets Stock Index Fund (which is an index fund with assets in excess of $75 billion at the end of 2012) saw its India allocation go up from 5.5% at the end of 2011 to 7.2% at the end of September 2012.

Besides emerging market funds, Asia Ex Japan equity funds and a few global equity funds also registered decent inflows in 2012. As per Morningstar data, Asia Ex Japan equity funds and ETFs cumulatively registered a net inflow of more than $6 billion in 2012. With a partial allocation to India in several of these fund’s portfolios, the country has been an indirect beneficiary of inflows into these funds. The asset flow of the 20 largest offshore funds with partial allocation to India is highlighted below.

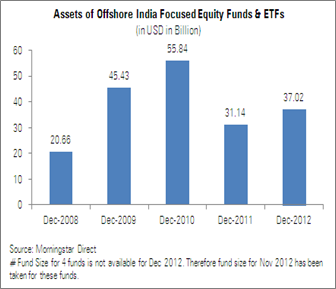

Asset Flows of 20 Largest Offshore Funds with Partial Allocation to India

In this section we evaluate the fund flows of diversified equity offshore funds with large asset allocations in India. We consider funds that do not belong to the Morningstar India Equity global category but still have a substantial investment in India. We included only open-end funds and ETFs that are not domiciled in India but have some exposure to India in their portfolios. We narrowed the field to the 20 funds with the largest exposure to India (in dollar terms) at the end of 2012, and calculated their estimated net flows into India for the year 2012.

Twelve of the top 20 funds with largest (partial) allocation to India in their portfolios (in dollar terms) at the end of 2012, were emerging market funds, most of which recorded strong inflows during the year. Again, this is just a sample of few offshore funds with large India exposure in their portfolio. This list does not include the India focused offshore funds or ETFs (which have been covered above).

Amongst emerging market funds, Virtus Emerging Markets Opportunities Fund recorded the highest estimated inflow into Indian stocks during the year 2012 of $786 million, helped by an overall inflow of $3.4 billion into the fund during the year. This active emerging market fund also saw its India allocation rise from 18.7% at the end of 2011 to 25.7% in September 2012 (on a net basis) as per last available data. The increased allocation to India in its portfolio would have also translated into increased inflows into Indian stocks. Incidentally, the manager of this fund (Rajiv Jain) also recently won the Morningstar International- Stock Fund Manager of the Year 2012 award. The fund is also a Morningstar 5-star rated fund.

Next in line was Vanguard Emerging Markets Stock Idx Fund, which recorded an estimated portfolio inflow into Indian stocks during 2012 of around $763 million, helped by an overall inflow of $11.7 billion into the fund during the year. The fund is a passive emerging market index fund with assets in excess of $75 billion at the end of 2012, of which an estimated $5 billion was invested in Indian stocks. Its net allocation to Indian stocks went up from 5.5% at the end of 2011 to 7.2% at the end of September 2012, helped by the outperformance of Indian stock markets during the year. Another emerging market index fund, iShares MSCI Emerging Markets Index Fund also registered an estimated inflow of $679 million into Indian stocks during the year 2012, helped by an overall inflow of $10.5 billion into the fund during the year.

Besides Virtus, other active emerging market funds like Oppenheimer Developing Markets Fund, Vontobel Emerging Markets Eq, and Aberdeen Global Emerging Markets Equity also registered robust portfolio flows into India, primarily helped by the strong overall inflows into these funds in 2012. A few Asia –ex Japan funds having partial allocation to India in their portfolios also saw decent inflows into Indian stocks. Aberdeen Global Asia Pacific Equity Fund registered an estimated portfolio inflow of $228 million into Indian stocks, helped primarily by an overall inflow of $1.9 billion into the fund during the year.

See Table of estimated net flows of 20 largest funds with partial allocation to India, below.

Estimated Net Flows of 20 Largest Funds with Partial Allocation to India during the Year 2012