Equity markets took a nasty tumble during the month of February, with almost all indices closing in the red. Rate sensitives like capital goods, realty, and banking took it on the chin during the month, and so did cyclical sectors like metals.

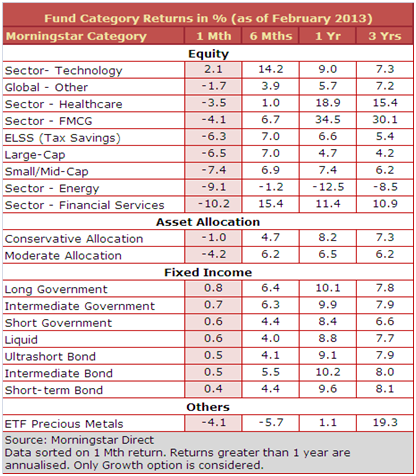

Diversified equity funds posted their worst monthly return since November 2011. Small/mid-cap equity funds fell heavily during the month of February 2013—delivering an average return of -7.4%. They still bettered the benchmark CNX Midcap and BSE Midcap indices, which fell by close to 10% during the month.

In the month of November 2011, small/mid-cap equity funds had posted an average loss of 8.20%. Large-cap equity funds delivered an average return of -6.5% in February--which makes it the worst monthly return since the month of November 2011, in which they posted an average loss of around 8%.

Financial sector funds were the bottom performers during the month, delivering an average return of -10.2%, compared to a -9.4% return posted by the BSE Bankex index.

The only silver lining in the falling markets of February was technology sector funds, which continued with their winning streak from the previous month and was the only category from the equity space to close in the green. These funds delivered an average return of 2.1% during the month of February, on the back of an average return of 9.6% clocked during the previous month.

However, due to their more diversified nature than the top-heavy benchmark IT indices, they relatively underperformed the indices during the month. Technology stocks fared well in February, benefiting from the good Q3 earnings and upgrades announced recently.

With the decline in bond yields during the month, government bond funds outperformed. Long government bond funds were the top performers, delivering an average return of 0.8% in February.

It was a disappointing month for gold ETFs as well, as they delivered an average return of -4% in February, making it their worst monthly performance since the month of December 2011.