Mutual funds in India have developed an increasing affinity for gilts or government securities lately.

The reason for this is quite commonly known. The RBI commenced with its monetary easing in early 2012. After cutting the cash reserve ratio (CRR) aggressively in the beginning of 2012, the central bank then cut the key policy rate (repo rate) by an aggressive 50 basis points (or 0.5%) in the month of April.

Although it kept the repo rate unchanged for a while, it continued to ease the CRR through 2012. In 2013, the central bank cut the repo rate twice, in January and in March.

Mutual funds have increased exposure to gilts significantly, although some moderation seems to be underway in 2013

Therefore the recent policy stance by the RBI has increased the appetite for gilts, to capitalize on the downtrend in interest rates. Gilts tend to be quite sensitive to interest rate movement and a preferred avenue in such a market environment.

Mutual funds have also warmed up to these instruments lately and increased exposure quite significantly, especially in the second half of 2012.

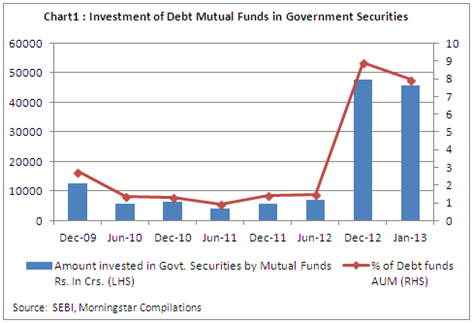

As per data from SEBI represented in Chart 1, total investments of mutual funds in government securities went up from Rs. 5,716 crores (or 1.4% of debt fund’s total AUM) at the end of 2011 to Rs. 47,699 crores (or 8.89% of debt fund’s total AUM) at the end of 2012—making it more than an 8-fold increase over the time period.

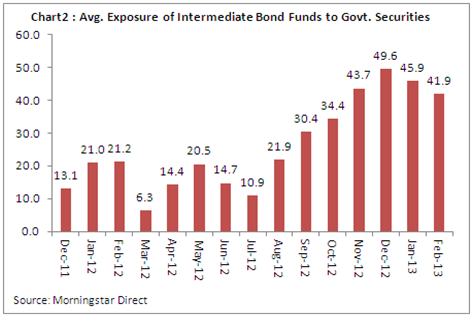

Similarly, exposure of income funds to government securities went up considerably over this same period. The average exposure to government securities of funds belonging to the Morningstar Intermediate Bond category went up from just 13% at the end of 2011 to almost 50% at the end of 2012 (refer to Chart 2).

The cumulative assets of these intermediate bond funds have also increased by a humongous 600% over the same period—therefore further catapulting their underlying investment in government securities.

Recently in 2013, some moderation in exposure seems to be underway, although it may be still early to establish if this trend will continue. The total investments of all debt mutual funds in government securities fell from Rs. 47,699 crores in the month of December 2012 to Rs. 45,712 crores in the month of January 2013, as per last available data from SEBI.

Meanwhile, as per Morningstar data the average exposure of intermediate bond funds to government securities moderated from 49.6% in the month of December 2012 to 41.9% in the month of February 2012.

However, it should also be noted that mutual funds constitute a small percentage ownership of the overall outstanding government securities in the market. As per RBI data, domestic mutual funds own 1.20% of the total outstanding government of India dated securities at the end of December 2012—although it is up from a mere 0.27% ownership a year back.

Commercial banks own about 34% of the overall outstanding government securities in the market, followed by insurance companies—who have a 19.5% ownership in the same at the end of 2012.

Gilt funds continue to register good inflows

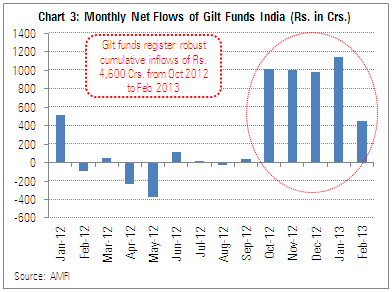

Gilt or government bond funds have also registered good inflows in the past few months. After seeing lackluster inflows for the first half of 2012, inflows into these funds picked up from the month of October 2012.

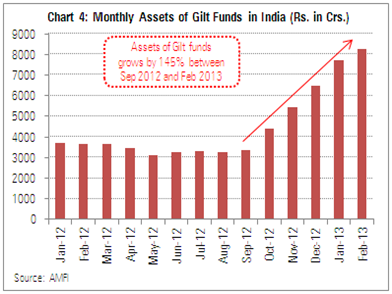

From October 2012 to February 2013, gilt funds registered a cumulative net inflow of Rs. 4,600 crores. The assets of gilt funds have also grown by 145%--from Rs. 3,356 crores at the end of September 2012 to Rs. 8,238 crores at the end of February 2013. Gilt funds constitute a small part of the overall assets of the fund industry (only about 1%), but the inflows into these funds lately does point to an increased appetite for such funds from investors.

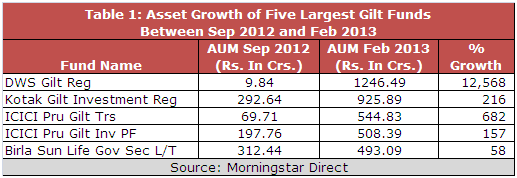

Individual gilt funds have also seen robust growth in assets since the month of September 2012. Table 1 below highlights the growth of assets between September 2012 and February 2013, of the five largest gilt funds (as of February 2013).

Certain funds like DWS Gilt fund have seen it assets growing several fold over the period, and has now emerged as the largest gilt fund at the end of February 2013. Assets of Kotak Gilt Investment Regular fund has also grown by a sharp 216% between September 2012 and February 2013. You can check out the top-rated funds and the star ratings of other funds within the Morningstar Intermediate Government Bond category and the Morningstar Long-Term Government Bond category by clicking on this link.

Gilt funds post strong returns, but are they suited to your risk profile?

Gilts are rated sovereign and therefore do not bear credit risk. However, as mentioned before, they are quite sensitive to interest rate movement and bear interest rate risk. When interest rates are softening, gilts and gilt funds deliver good returns and tend to outperform other shorter tenure bond funds. However, when interest rates harden or rise, gilt funds tend to underperform, and even deliver negative returns if rates move up sharply.

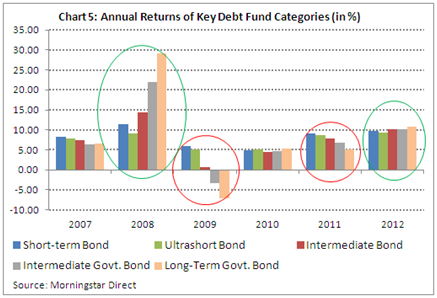

Over the past year (ended February 2013), the long-term government bond fund category has been the top performing category within the fixed income space—delivering an average return of more than 10%. The higher duration of these funds helped them to capitalize on the downtrend in interest rates over the past year. Chart 5 below highlights the annual returns of some key debt fund categories. In 2008, when the RBI cut rates sharply after the Lehman crisis, gilt funds (both long-term and intermediate) outperformed by a significant margin. Intermediate govt. bond funds delivered an average return of 22%, while long-term govt. bond funds delivered an average return of 29% during the year. Similarly, with interest rates softening in 2012, both long-term and intermediate govt. bond funds outperformed.

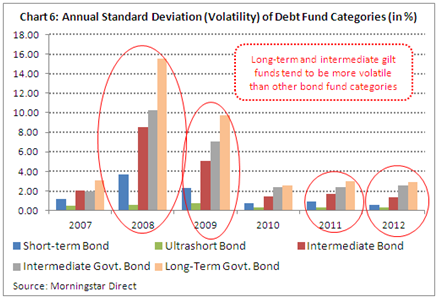

However, during the year 2009, when interest rates hardened significantly, both intermediate and long-term gilt funds posted negative returns during the year. In 2011 as well, with interest rates hardening, gilt funds underperformed short-term and ultrashort bond funds by a decent margin. Therefore, investors should be cognizant of the interest rate risk that gilt funds bear. Chart 6 highlights the annual standard deviation (a measure of volatility) of various debt fund categories. It can be seen that both long-term and intermediate gilt funds tend to be more volatile than other debt fund categories. This is primarily because gilts are more sensitive to interest rate movement and the volatility spikes especially when there is any sharp movement in interest rates.

Conclusion

Investors who cannot digest volatility in returns, or who are more passive in nature, can choose other investments avenues like dynamic bond funds, if they want to capitalize on the fall in interest rates. In dynamic bond funds the duration is managed more dynamically by the fund manager, depending on the interest rate environment. Fund managers have been raising duration in intermediate and dynamic bond funds, by increasing exposure to gilts in their underlying portfolios. If you are not the one who tracks markets closely and can identify interest rate trends, then it probably makes sense to leave that decision to be taken by the fund manager of the dynamic bond fund, who maybe in a more capable position of taking that call and manage duration of the fund accordingly.

After all, it is always prudent to assess the underlying risk, rather than blindly chasing past returns. Investors should bear in mind that interest rates and bond yields have moved down considerably over the past year or so. The potential for further rate cuts appear to be more limited at this juncture, and therefore investors need to moderate their return expectations from these funds accordingly, when compared to the previous year.