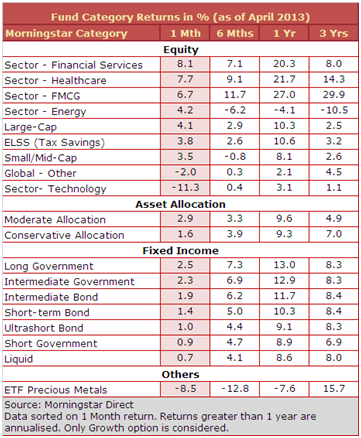

Diversified equity funds bounced back in the month of April, after posting losses in the previous month. Large-cap equity funds posted an average gain of 4.1% during the month, compared to BSE Sensex’s 3.6% gain. Small/mid-cap equity funds trailed— with an average gain of 3.5% in April, compared to 3.3% and 5.6% returned by the BSE Midcap index and CNX Midcap index respectively during the month.

Financial sector funds recovered strongly in April, after posting losses in the previous month. They posted an average gain of 8.1% April, compared to a 10.2% return posted by the BSE Bankex index during the same period. Defensive sector funds like healthcare and FMCG also fared well during the month.

The biggest losers from the equity space in April were technology sector funds, which were battered after the disappointing Q4 results announced by IT major Infosys. The Infosys stock fell by more than 22% during the month, causing the top-heavy BSE IT index to lose around 17% in April. Meanwhile technology sector funds, which are more diversified in nature, fared better—delivering an average return of -11.3% during the month.

Global funds also did not fare well, with the Morningstar Global-Other category delivering a -2% return in April.

It was also a disappointing month for gold, as the precious metal got battered mid-month. Gold ETFs tracking the price of the yellow metal posted their worst monthly return (of -8.5%) in around four-and-half years. The last time gold ETFs had fallen more was the month of October 2008, when they posted an average loss of more than 14%.

Bond yields eased during April, benefiting from expectations of rate-cuts by the RBI on account of falling inflation. With the decline in bond yields, government bond funds outperformed. Long government bond funds were the top performers—delivering an average return of 2.5% during the month. They were followed closely by the Intermediate Government Bond category, which delivered a 2.3% return. Liquid funds underperformed—delivering a 0.7% return in April.