Is it the stock market running on just liquidity?

Don’t conflate liquidity with flow. For every buy, there is a sell; hence the net flow is always zero. Consequently, liquidity defined by flows is faulty.

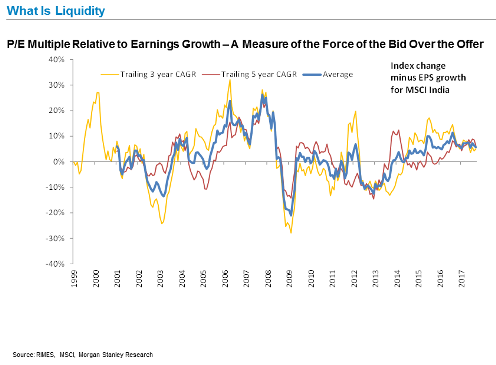

Liquidity is the force of the bid and the offer. When liquidity is rising, the force is on the side of the bid. When liquidity is falling, the force is on the side of the offer.

In 2008, liquidity was turning negative because there was more force on the offer than on the bid. Right now, the reverse is taking place so liquidity is rising.

One model to measure liquidity is the gap between the market multiple and market earnings growth. If that gap is rising, it indicates rising liquidity. If that gap is falling, it indicates declining liquidity.

Currently, the gap is not stark but in the middle of the range. This indicates that liquidity is still building up in this market and has not peaked. When the gap gets extremely wide, it would point to an exuberant market.