Is India’s PE ratio too high?

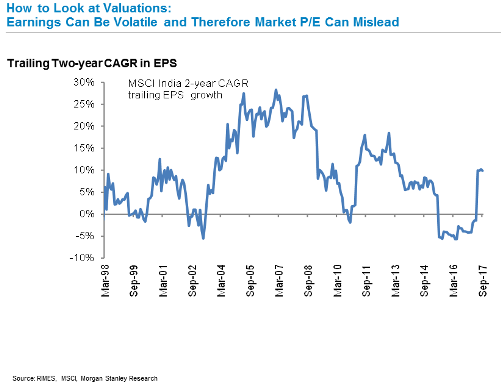

The problem with looking at the PE ratio is that earnings is a cyclical variable that fluctuates.

If earnings are high, the PE will appear low. Does that mean the market is cheap? Probably not because earnings will then fall.

If earnings are low, which they have been for the past 3-4 years, PE multiples are high. Does that make the market expensive? Probably not because earnings are going to rise.

Since the market is forward looking, the PE is a bad metric to judge valuation.

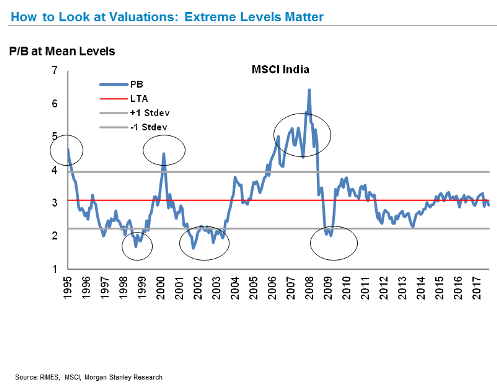

Does the PB ratio say that valuations are stretched?

If we use the more stable PB ratio, we see that valuations are neither too cheap, nor too rich. India’s range has spanned between 2 and 5.5 and right now we are at 3. When it starts inching towards 5x BV, that would be the signal to exit stocks.

Valuations have usefulness only at extremes. They are rather irrelevant when they are in the middle of the range.

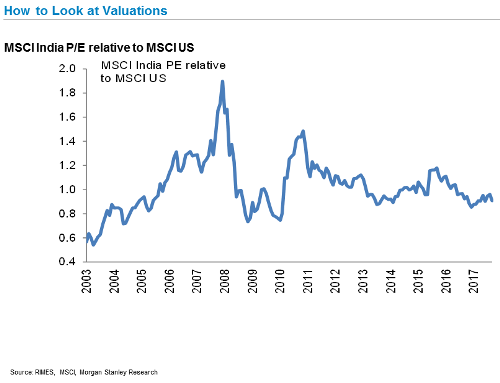

Don't look at valuations from an absolute context. Valuations are always relative. Equities do not operate in a vacuum. They trade relative to interest rates, relative to other markets, and so on and so forth. Take a look at India’s PE relative to the U.S. market and you will see that it hit an all time low a few months ago.

In fact, if you take the 10-year bond, which is usually the benchmark, it is at 6.5% right now. so bonds are trading at 16x earnings (the inverse of 6½). Equities are trading at 18x earnings. The bond cash flow (coupon) will terminate at the end of 10 years. Equities cash flow (dividends) go way beyond the 10 years. So equities are much cheaper.