There have been market downturns and panics before. But the trigger this time around puts us in extremely unfamiliar territory. Who would have envisaged this dystopian future of deliberate government shutdowns impacting all life and sending epic shocks through economies?

While the market downturn, extreme volatility, and global reverberations make one compare this to the Global Financial Crisis (GFC), it really is not the same. That was a housing bubble fuelled by risky lending practices designed to be offset through leveraged financial instruments known as credit default swaps. This time around, there is no systemic collapse of the financial system.

I love the way CULLEN ROCHE very succinctly explained why the GFC was unique.

Debt crises and financial panics are as old as the U.S. economy. What made the GFC unique was that a single sector was at the heart of the downturn.

Importantly, it wasn't the sheer size of the real estate market as a portion of GDP that mattered in 2008. It was the size of housing as a portion of private sector debt. At 75% of household debt, the housing sector is tremendously important to the stability of the U.S. economy. So, if you get a debt crisis in housing, you get a crisis in the economy. But debt alone isn't problematic, but a housing price boom connected to all that debt. And when prices collapsed, it was like a match on gasoline.

ERIC JACOBSON, Morningstar’s senior analyst covering fixed-income strategies, shared his views on what is different from 2008.

Going into 2008, a lot of funds were taking on a lot more risks, and risks that today we would probably even consider kind of extreme. They had leverage, they were layering on credit derivatives, and so forth. Even though it wasn't a huge number of funds, it was a formula for disaster.

The crisis was not only a liquidity crisis but also a solvency crisis. There were a lot of things that funds held that were at risk of default, and some did default. There was a lot of damage done in the underlying markets.

This time around, what we've been looking at is really just a liquidity risk, and it's the one that the Federal Reserve has stepped in and really managed pretty well by funneling money into the system. So, there's a really good chance that, when all is said and done, investors probably aren't going to suffer permanent losses as a result of defaults and so forth. But we've obviously had an ton of market volatility.

The banking system is better off than it had been. There are a lot of lessons that went unheeded after the GFC. But the banking regulators stepped in, they built up banking rules and encouraged and pushed banks to have much better capital cushions. And as a result of that, today, the banking system is not at the centre of this crisis, and in fact, is well positioned to be a tool to help solve it.

The CFA Institute blog had an interesting take on the unemployment in the U.S.

Unemployment usually means that people want to work but employers can’t find anything for them to do, or can’t afford to pay them. This time really is different. Most people want to work but they are not allowed to. Their employers would love to have them back and could pay them if customers were allowed to frequent their businesses.

What has been destroyed in this crisis? The buildings are there, the human capital is there, and most of the financial capital is still there. It’s the social capital that is impaired, but only for a while. We will get through this, but only if the worries we enumerate below do not come to pass.

In other words, the jobs aren’t “lost.” Many of them will come back right away when the lockdown abates. Others will take longer. Sadly, some businesses will not recover. Some would have failed anyway, but many vibrant enterprises that won’t be brought back wouldn’t have. This contrasts with the usual meaning of “lost jobs” — those rendered unnecessary and unlikely to return due to a change in technology, industry consolidation, or foreign competition. That is not the case in the current crisis.

Morningstar’s equity analyst PRESTON CALDWELL and KAREN ANDERSEN Andersen, healthcare strategist, did an extremely detailed analysis to arrive at the Long-Term Economic Impact Forecast.

They looked at 3 scenarios:

- Base Case: 3-month broad shutdown, more moderate 2nd-wave shutdown

- Bull Case: Successful Containment and surveillance, business largely reopens in June

- Bear Case: Longer economic shutdown, late mitigation, lack of pipeline progress

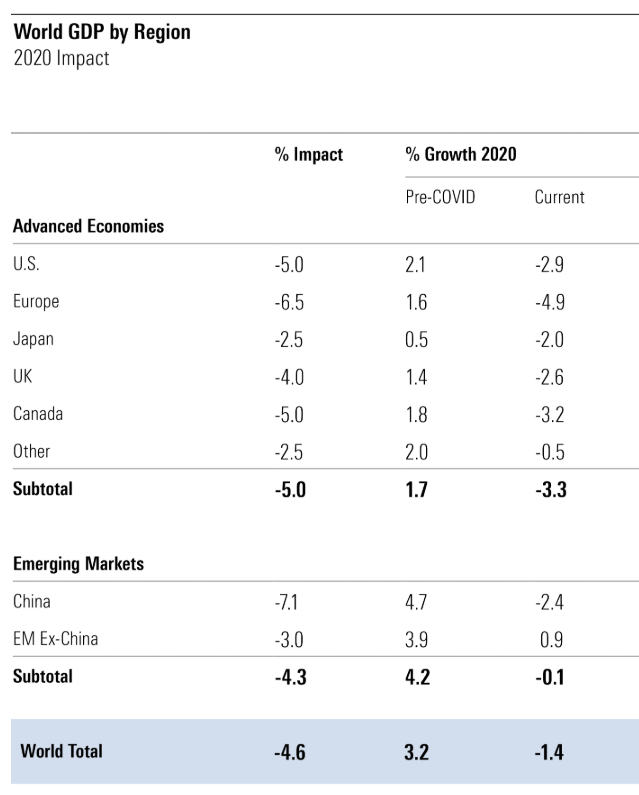

They projected the impact of COVID-19 on U.S. GDP in 2020 in each of the scenarios. To account for the asymmetry of risk across the scenarios, the forecast is a probability-weighted average. On average, they project a 5% hit to U.S. 2020 GDP. Taking the IMF’s January 2020 forecast of 2.1% real GDP growth for the U.S. as the pre-COVID forecast, this results in an updated U.S. 2020 GDP growth forecast of negative 2.9%.

They forecast:

- 9% contraction in U.S. GDP in 2020, but anticipate that the scope of the shutdown to disrupt the economy in the long term is likely overrated.

- The fiscal stimulus should prevent a collapse in demand.

- A COVID-19 recession doesn’t fit the mould of a 2008-style recession with longer-lasting economic impact.

- The U.S. long-term economic impact to be less than the 2008 recession.

Overall, they expect a modest long-run economic impact, but a COVID-19 recession doesn’t fit the mould of a 2008-style recession with longer-lasting economic impact.