We have recently published the India Domestic Fund Flows Report for the quarter ended March 2022. This report provides insights into estimated flows, asset trends, and performance for domestic funds focused on the Indian equity and debt market.

Let’s look at funds that received the highest inflows and outflows during March quarter 2022.

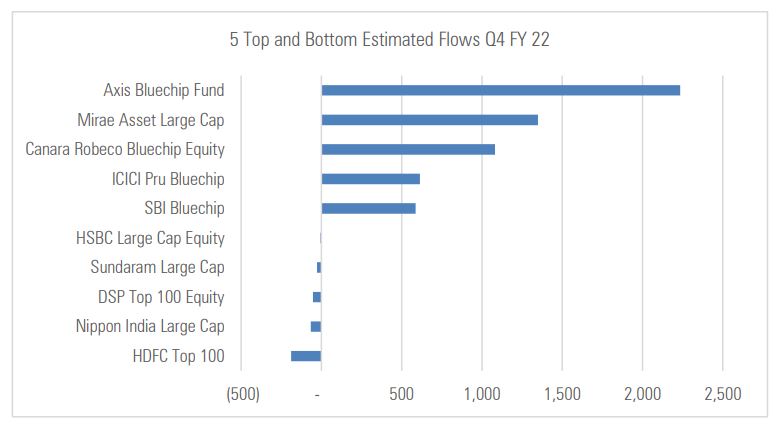

Large Cap Funds

March quarter

Large-cap funds received net inflows worth Rs 7,281 crore in the fourth-quarter fiscal-year 2021-22, which was significantly higher than the net inflows in the previous quarter at Rs 3,950 crore.

Like in the previous four quarters, Axis Bluechip Fund, Mirae Asset Large Cap Fund, and Canara Robeco Bluechip Equity Fund continue to be among the top three funds to receive the highest net flows during the quarter. They garnered net inflows worth Rs 2,234 crore; Rs 1,349 crore; and Rs 1,081 crore, respectively, in fourth-quarter fiscal-year 2021-22.

On the other hand, funds that had the highest outflows in fourth-quarter fiscal-year 2021-22 were HDFC Top 100 Fund with Rs 189 crore, followed by Nippon India Large Cap Fund with Rs 66 crore, and DSP Top 100 Equity Fund with Rs 53 crore.

Fiscal-year 2021-22

Funds with the highest net inflows in fiscal-year 2021-22 were Axis Bluechip Fund (Rs 7,129 crore), followed by Canara Robeco Bluechip Fund (Rs 4,062 crore), and Mirae Asset Large Cap Fund (Rs 3,714 crore). Funds with the highest net outflows during the same period were Aditya Birla Frontline Equity Fund, HDFC Top 100 Fund, and Nippon India Large Cap Fund, with outflows of Rs 1,672 crore, Rs 1,302 crore, and Rs 1,260 crore, respectively.

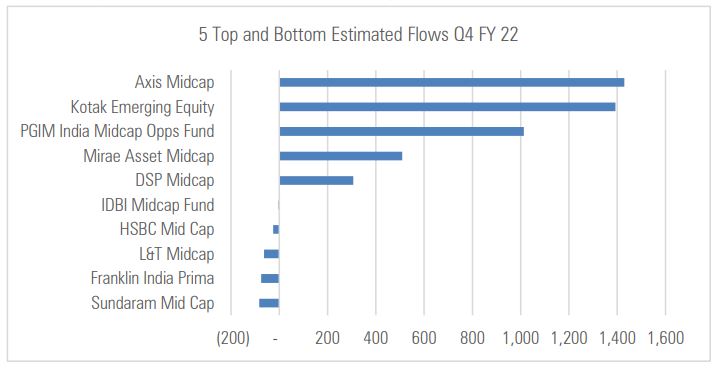

Mid-Cap Funds

March quarter

The mid-cap category had net inflows of funds for the fifth-consecutive quarter, wherein it managed to garner flows of Rs 5,918 crore in the fourth quarter of fiscal-year 2021-22. This is the highest net flows the category has witnessed in 12 quarters.

Like in the last few quarters, the funds that continue to be among the highest recipients of net inflows in fourth-quarter fiscal-year 2021-22 were Axis Midcap Fund (Rs 1,430 crore), Kotak Emerging Equity Scheme (Rs 1,393 crore), and PGIM India Midcap Opportunities Fund (Rs 1,013 crore), On the other hand, with net outflows of Rs 83 crore, Sundaram Mid Cap Fund recorded the highest net outflows during this quarter. This was followed by Franklin India Prima Fund and L&T Midcap Fund, which had outflows of Rs 75 crore and Rs 63 crore, respectively.

Fiscal 2021-22

Funds with the highest net inflows in fiscal 2021-22 were Kotak Emerging Equity Scheme (Rs 4,742 crore) followed by Axis Midcap Fund (Rs 4,595 crore), and PGIM India Midcap Opportunities Fund (Rs 3,242 crore). Funds with the highest net outflows in fiscal 2021-22 were HDFC Midcap Opportunities Fund (Rs 1,374 crore), followed by Franklin India Prima Fund and L&T Midcap Fund with Rs 983 crore and Rs 815 crore, respectively.

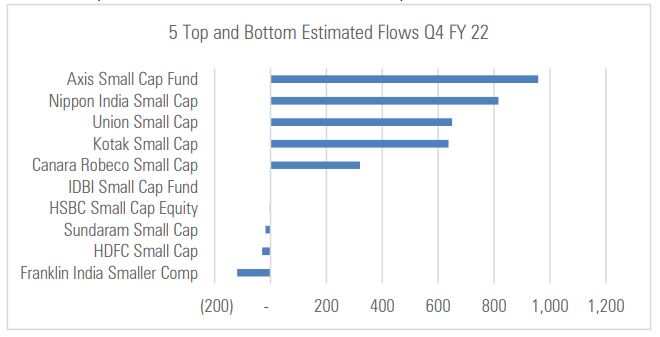

Small-Cap Funds

March quarter

The small-cap category had net inflows of Rs 4,624 crore in the fourth quarter of fiscal-year 2021-22. This is the fourth-consecutive quarter in which the category has witnessed net inflows after going through three straight quarters of net outflows.

Axis Small Cap Fund, with net inflows of Rs 958 crore, received the highest flows during the quarter. This was followed by Nippon India Small Cap Fund (Rs 815 crore) and Union Small Cap Fund (Rs 650 crore). During the fourth-quarter fiscal-year 2021-22, Franklin India Smaller Companies Fund had the highest net outflows—Rs 120 crore—followed by HDFC Small Cap Fund and Sundaram Small Cap Fund. Both saw negligible net outflows of around Rs 30 crore and Rs 18 crore, respectively.

Fiscal 2021-22

Fiscal 2021-22

Funds that saw the highest net inflows in fiscal-year 2021-22 were Axis Small Cap Fund (Rs 2,531 crore), followed by Kotak Small Cap (Rs 2,358 crore) and PGIM India Small Cap (Rs 1,615 crore). PGIM India Small Cap was launched only in July 2021. Funds that saw the highest net outflows in fiscal-year 2021-22 were Franklin India Smaller Companies Fund (Rs 1,220 crore), followed by HDFC Small Cap Fund and L&T Emerging Businesses Fund, with Rs 825 crore and Rs 520 crore, respectively.

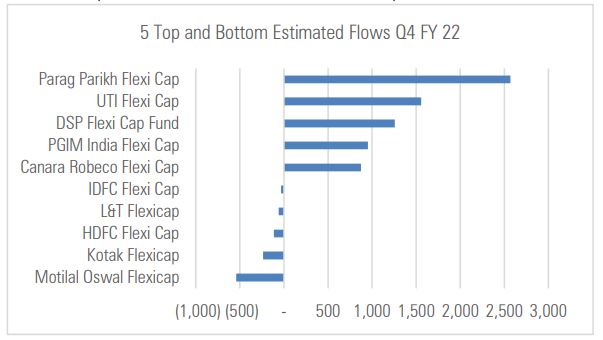

Flexi-Cap Funds

March quarter

During the fourth quarter of fiscal-year 2021-22, the Flexi Cap category had net inflows worth Rs 8,950 crore, which was the second-highest among the open-end equity categories.

The funds that received the highest net inflows in third-quarter fiscal-year 2021-22 were Parag Parikh Flexi Cap Fund, with Rs 2,569 crore, followed by UTI Flexi Cap Fund with Rs (1,557 crore) and DSP Flexi Cap Fund with Rs 1,256 crore.

On the other hand, with net outflows of Rs 542 crore, Motilal Oswal Flexi Cap Fund recorded the highest net outflows during the quarter. This was followed by Kotak Flexicap Fund and HDFC Flexi Cap Fund, which lost Rs 237 crore and Rs 114 crore, respectively.

Fiscal 2021-22

Funds that saw the highest net inflows in fiscal-year 2021-22 were ICICI Prudential Flexi Cap Fund (Rs 11,247 crore), followed by Parag Parikh Flexi Cap Fund (Rs 10,678 crore) and UTI Flexi Cap Fund (Rs 5,651 crore). ICICI Prudential Flexi Cap Fund was launched in July 2021. Funds that saw the highest net outflows in fiscal 2021-22 were Kotak Flexicap Fund (Rs 2,916 crore), followed by Motilal Oswal Flexi Cap Fund and HDFC Flexi Cap Fund with Rs 2,574 crore, and Rs 1,668 crore, respectively.