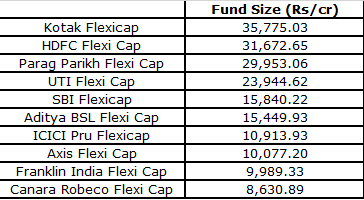

The flexi-cap is the largest open-ended equity category in the mutual fund space, with a collective AUM of Rs 2,40,790 crore.

Looking at the assets under management (AUM), it is clearly a favourite of investors. Mirae Asset is the latest entrant in this category. Their recently launched flexi-cap fund (February 2023) has an AUM of approximately Rs 604 crore.

The Multi-Cap category is different.

First things first. A lot of investors seem to conflate the two categories, so let me draw a distinction. A multi-cap fund and a flexi-cap fund are both diversified equity funds, the significant difference being the mandated exposure to various market caps.

Multi-cap funds have a mandatory allocation of 25% each to the three different market capitalizations - small, mid and large cap. So, a fund could have a 50% allocation to large-cap stocks, but will ensure that the allocation to mid and small caps are 25% each. Or, it could be a 40% allocation to mid caps, a 35% allocation to large caps and a 25% allocation to small caps.

Flexi-cap funds have the leeway to dynamically move across the market-cap categories based on the fund manager’s strategy and outlook for each. There is no restriction on the level of exposure towards the three segments. It is a go-anywhere strategy where the fund manager will invest depending on where he sees optimal value. There could be periods when the allocation to any specific market cap is almost negligent.

As of December 2021, the flexi-cap category maintained an average exposure of 76% in large caps, while the multi-cap category had an average exposure of 54% towards large caps. By February 2023, the exposure and around 66% (flexi cap) and 41% (multi cap). So as you can see, both are nimble.

So which one?

It could be perceived that multi-cap funds are relatively riskier as compared to flexi-cap funds since a minimum of 50% of the portfolio is allocated to mid and small caps. Having said that, the fund manager of a flexi-cap fund may decide to move the bulks of his assets to the mid and small cap segment if he finds value there. But, if the segment is getting hammered in the market, he may choose to find refuge in large caps, so the downside could be protected to some extent. But if there is a sudden rally, he may miss out on the gains due to his strategic allocation.

While this sounds very dynamic and appealing, do remember that the churn in the portfolio would be high. Moving 10% out of mid caps and increasing 10% in large caps, just to cite an example, is easier said that done. The fund manager has to keep liquidity and valuations on his radar constantly.

Frankly, there is no right or wrong.

- Start with what works for you. What may be the right path for another investor could be the worst one for you.

The allocation to large, mid and small caps are a function of both, the risk appetite and time horizon for an investor. An aggressive investor can choose to have a higher allocation to smaller fare compared to a relatively conservative investor who should ideally have a higher allocation to large caps.

If an investor is able to track the market on a regular basis and execute changes to the portfolio comfortably based on market changes, then choosing to have separate funds basis his/her risk profile and time horizon works.

On the other hand, if you do not have the time and knowledge or even inclination to track the market on a regular basis and execute changes required (if any); then, choosing a flexi cap fund would be a good way to invest as you then indirectly enable the fund manager to take these calls on your behalf.

When it comes to portfolio construction (for equity), you can start of by choosing top-rated funds across categories and different AMCs to form a well-diversified portfolio. While rating is one measure to select a fund in the portfolio, it is also important to look at the fund manager’s style; how diversified the portfolio and how concentrated the bets.

For instance, with reference to flexi caps, some funds may be managed with a growth biased approach, while some may have a value style or growth at a reasonable price (GARP). For instance, Kotak Flexi Cap has been consistently plying a growth centric approach, on the other hand HDFC Flexi Cap runs with a value bent. While funds will perform very differently in similar market conditions. A few flexi-cap funds also have global exposure as a diversification feature, such as Parag Parikh Flexi Cap Fund.

While on its own, a number of funds can be categorized as “good funds”, it is important to see how it fits in with your overall portfolio. Ideally, investors should have a mix of different strategies in the portfolio which would help them achieve diversification across asset allocation, market capitalization, asset management companies, geographies and investment styles.