The below is an extract from the India Domestic Fund Flows Q3 FY23 report. This report provides insights into estimated flows, asset trends, and performance for domestic funds focused on the Indian equity and debt market.

SBI Mutual Fund experienced the most inflows last year.

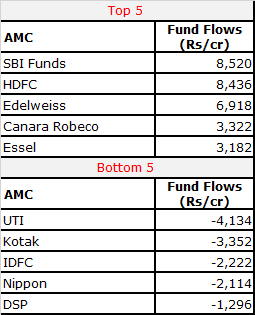

Quarter: October-December 2022

SBI Mutual Fund was aided by strong net inflows into its ETFs:

- SBI Nifty 50 ETF (Rs 4,706 cr)

- SBI S&P BSE Sensex ETF (Rs 3,511 cr)

On the other hand, an exodus of funds from the liquid category (Rs 4,670 cr) and overnight category (Rs 3,890 cr), among others, led to UTI AMC finding a place among the AMCs with the highest net outflows during the quarter.

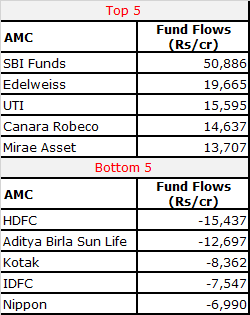

Calendar Year: 2022

Just as in the quarter ended December 2022, over the calendar year 2022, too, SBI Mutual Fund was aided with strong net inflows in its ETFs:

- SBI Nifty 50 ETF (Rs 23,865 cr)

- SBI S&P BSE Sensex ETF (Rs 19,104 cr)

Abbreviations:

- ETF: Exchange Traded Fund

- AMC: Asset Management Company

Do Note:

- All figures are in Indian rupees unless otherwise stated.

- The data is of domestic open-end funds and ETFs

- Data is as of December 2022

- A domestic fund is one that is domiciled in India and invests primarily in Indian markets. In this report,

we have included the asset flows of funds and ETFs with an allocation to Indian stocks and bonds as of

December 2022.

- This report provides insights into estimated flows, asset trends, and performance for domestic funds focused on the Indian equity and debt market. The flows are estimated from assets and total returns for the quarter ended December 2022. Morningstar calculates estimated net cash flows for global open-end funds and exchange-traded funds, an estimate of the money put in or withdrawn by fund investors, accounting for reinvestment of distributions.

- The disclosure of daily net assets is at the discretion of the fund provider.