What to Note:

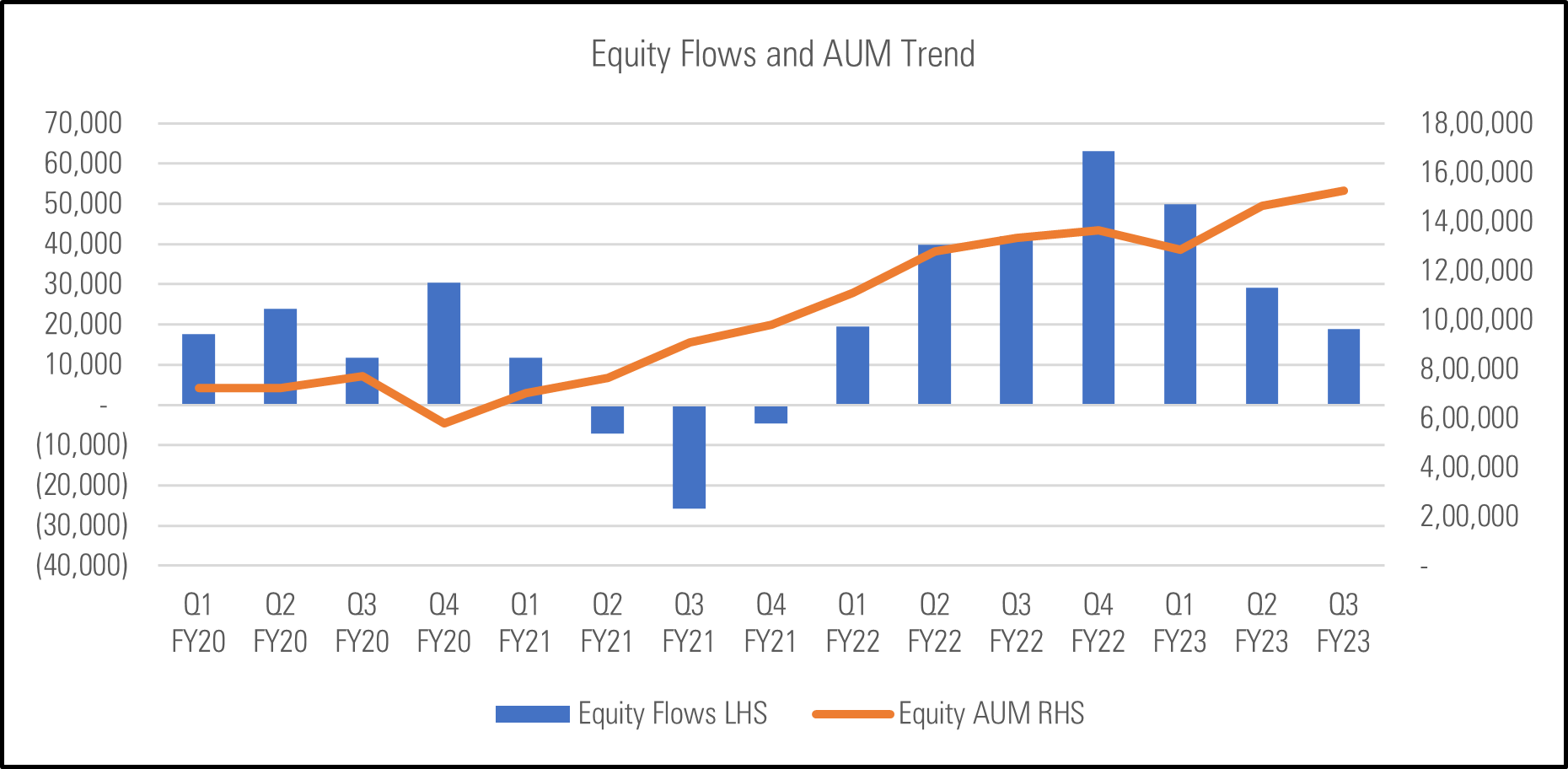

- Over the last year, the total AUM of open-end equity funds has grown by a sharp 14.3%.

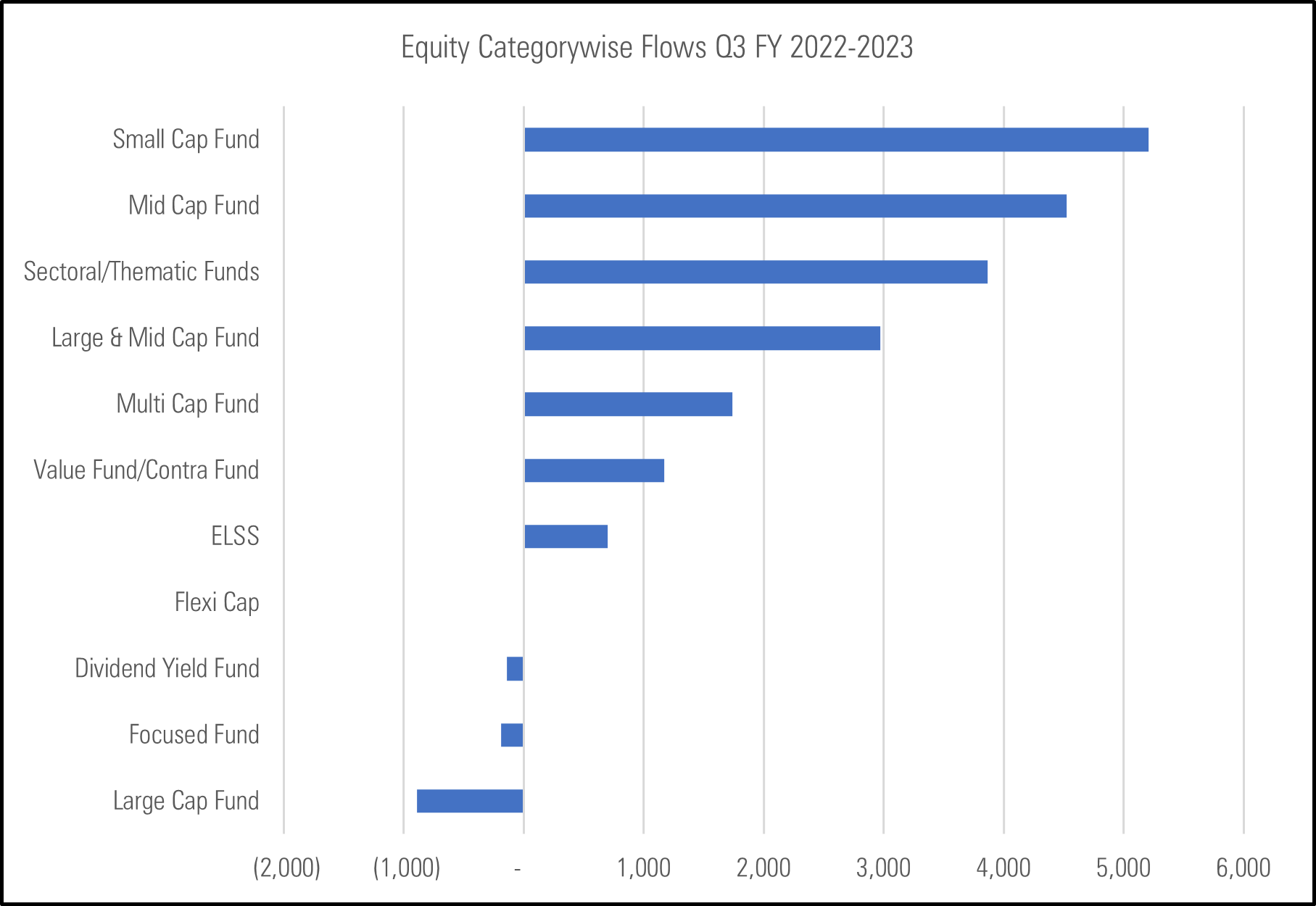

- This growth is despite the asset class witnessing a reduction in net inflows every quarter over the last three quarters.

- The assets of all 11 equity categories are at the highest as of December 2022.

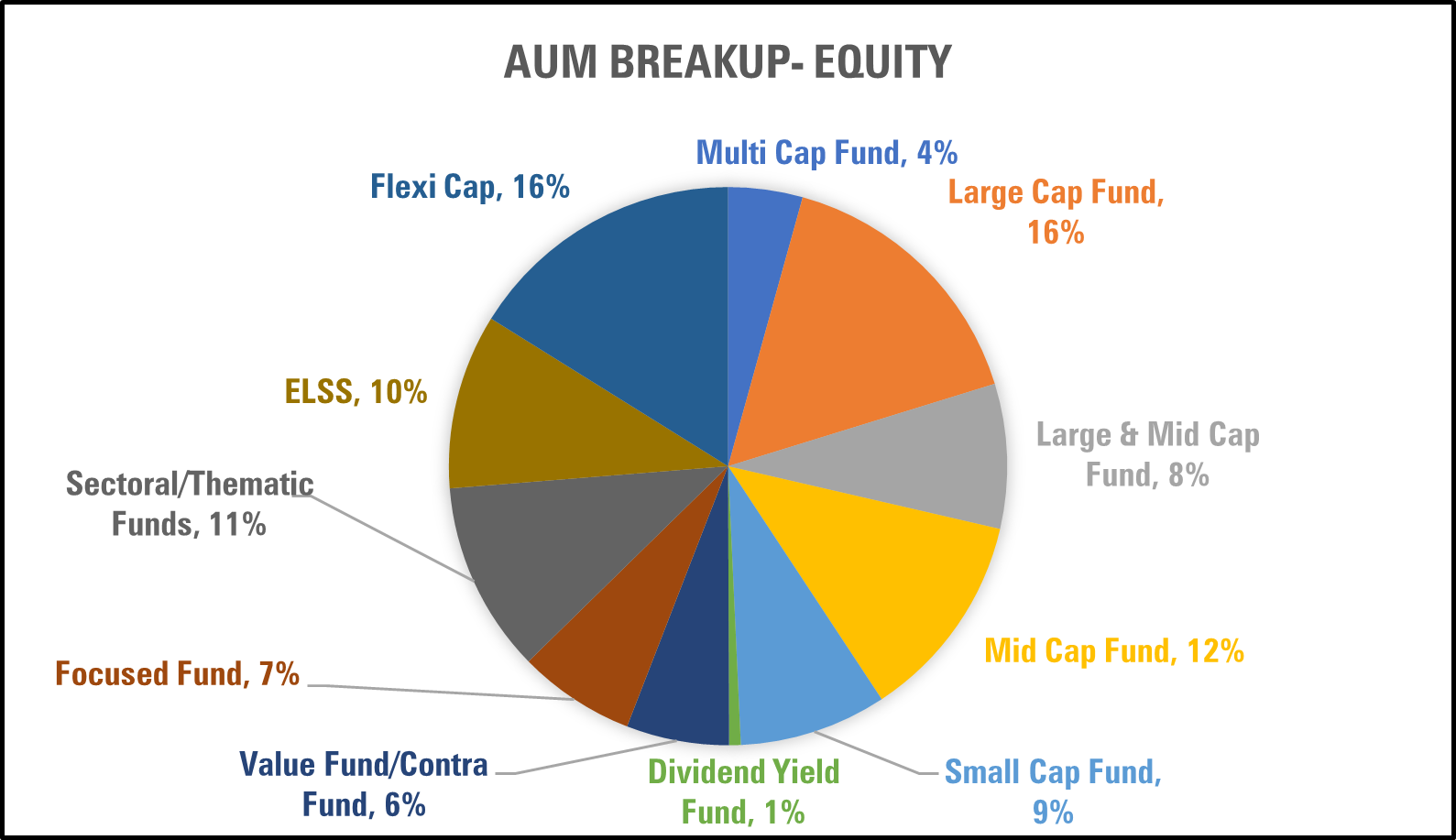

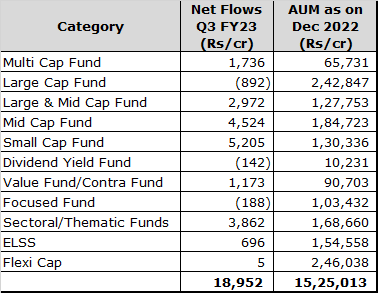

The total asset under management (AUM) of open-end equity funds as of December 2022 stood at Rs 15,25,013 cr, up by a 4% over the last quarter. Open-end equity funds form approximately 39% of the total open-end fund universe.

The rise in assets has been due to the asset class receiving consistent net inflows coupled with favourable market conditions over the quarter. During the quarter ended December 2022, S&P BSE 100 TR rose by 5.08%, and the BSE Midcap and BSE Smallcap rose by 2.04% and 1.74%, respectively.

Click on images to enlarge

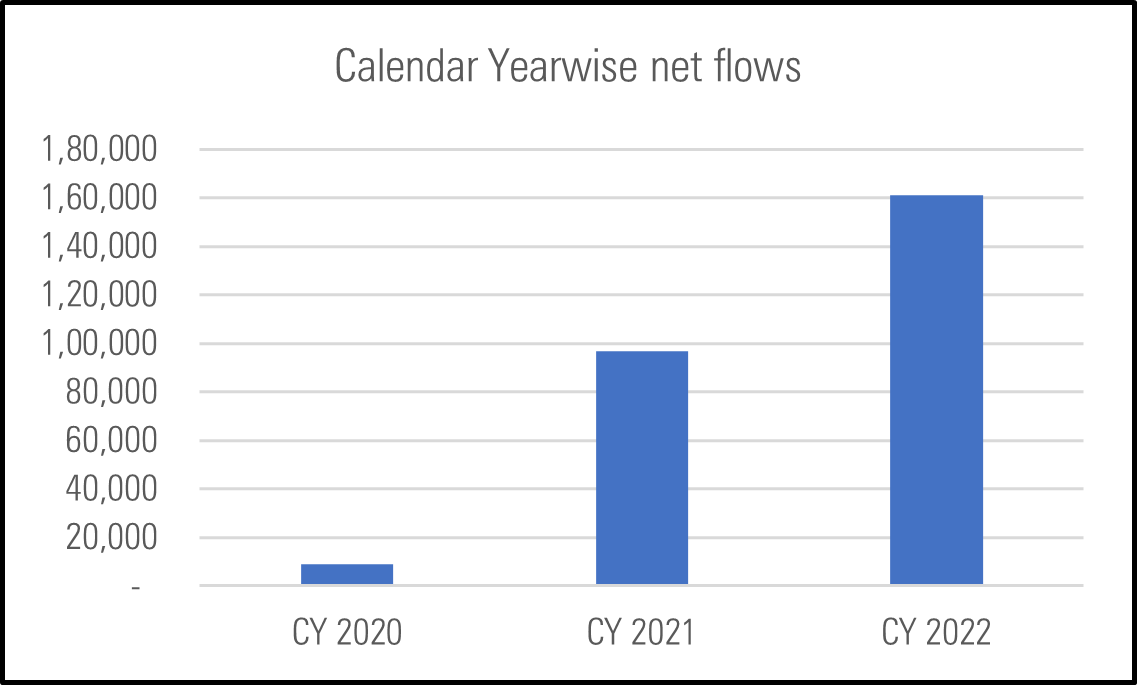

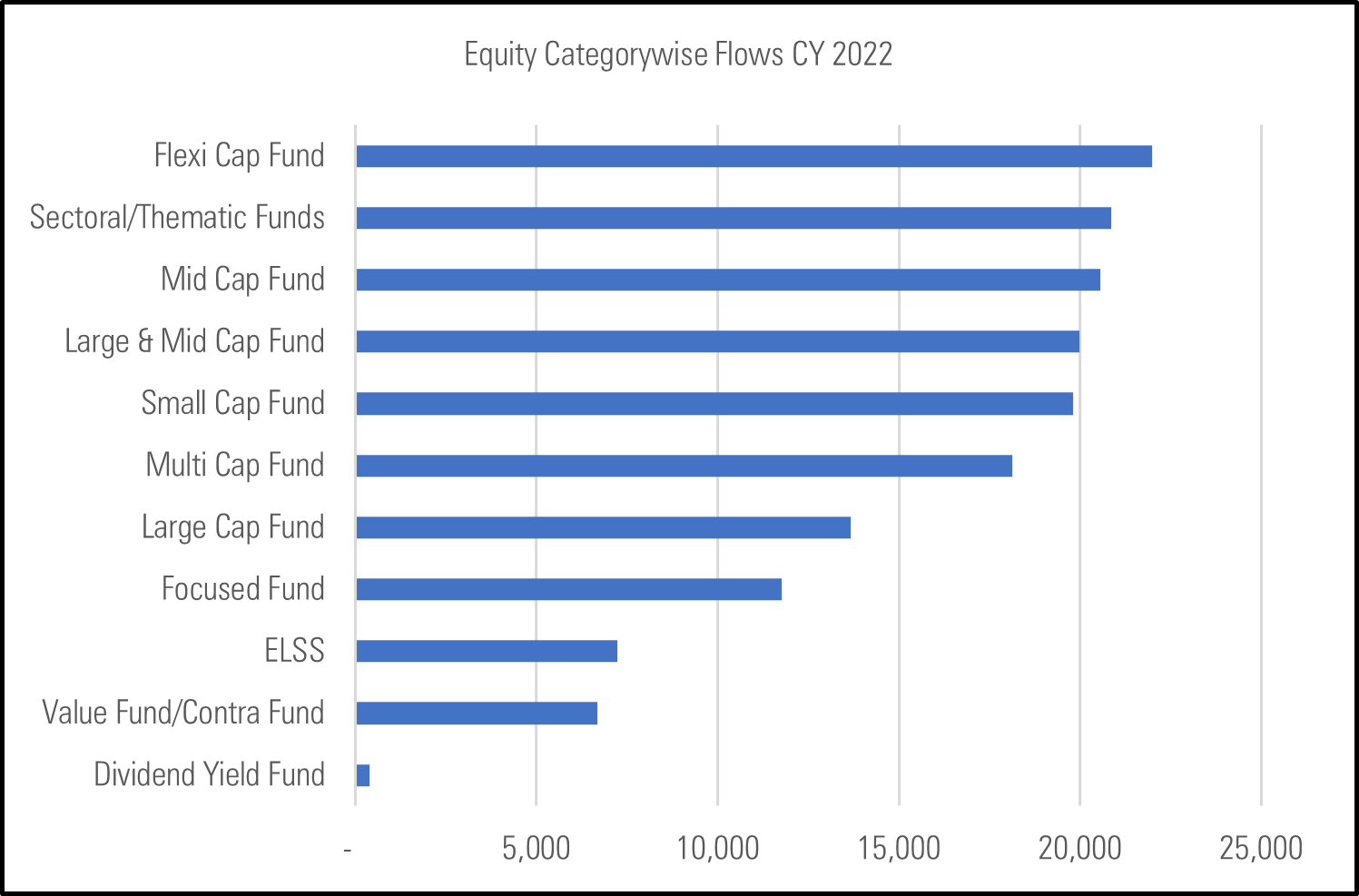

While the net inflows in equities over the last few quarters have shown a downward trajectory, when we compare the calendar year-wise net inflows, the growth is quite impressive.

Source: AMFI data / Date as on December 2022 / All figures in Rs/cr

According to Senior Research Analyst Kavitha Krishnan, the reduction in flows, especially in large cap and flexi cap, could be attributed to some amount of profit booking during the quarter. Also, given the correction in mid and small caps over the last year, investors have been steadily allocating their money towards this segment of the market, possibly viewing this as a good investment opportunity. It is worth pointing out that equity index funds and exchange traded funds (ETFs) have been witnessing steady inflows which could therefore mean investors could also be moving to passive funds as opposed to active funds in the large-cap segment.

Source: AMFI data / Date as on December 2022 / All figures in Rs/cr