The January-March 2023 quarter saw 90 NFOs. Cumulatively, they garnered Rs 20,173 crores.

SBI Dividend Yield Fund garnered the highest flows at the inception (NFO) stage (Rs 3,496 crores), followed by Axis Business Cycle Fund (Rs 2,089 crores), Aditya BSL Multi Asset Fund (Rs 1,572 crores) and HSBC Multicap Fund (Rs 1,204 crores).

In FY23, a total of 182 open-end funds and ETFs and 71 closed-end funds were launched. Cumulatively, they garnered Rs 62,342 crores.

Flows in the January-March 2023 quarter

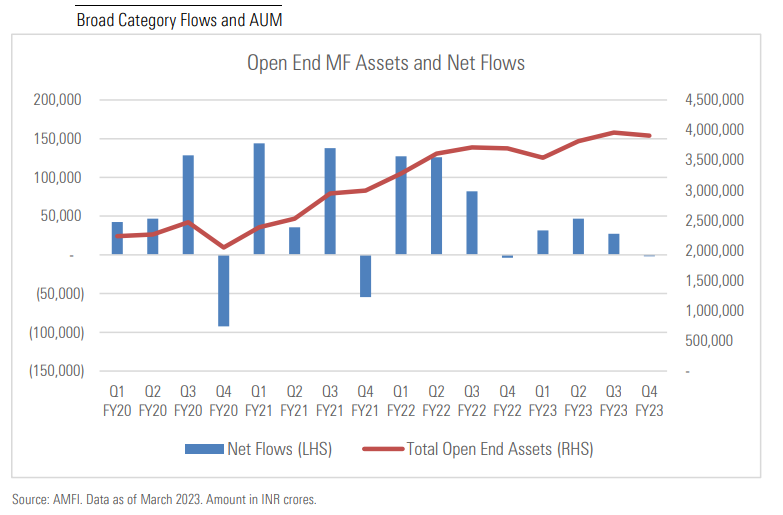

AUM of open-end funds stood at Rs 39,07,873 crores as of March 31, 2023.

Open-end mutual funds: Net outflows of Rs 1,839 crores (after witnessing net inflows during the first three quarters of FY23).

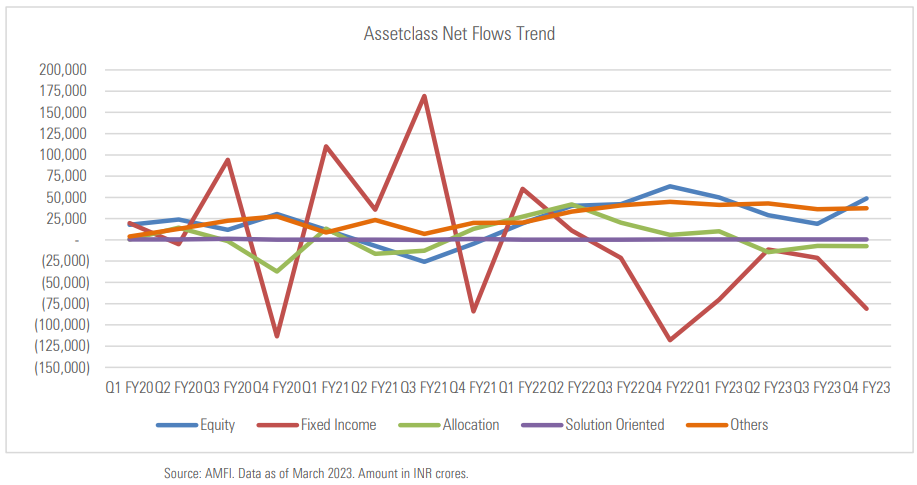

Open-end equity funds: Net inflows of Rs 48,766 crores. Total AUM at Rs 15,17,082 crores.

Open-end fixed-income funds: Net outflows of Rs 81,016 crores. Total AUM at Rs 11,81,982 crores.

"Other Schemes" category: This typically has subcategories of ETFs (other and gold), index funds, and FoF overseas. Net inflows of Rs 37,247 crores.

click on images to enlarge

Note:

- The above is an extract from the India Domestic Fund Flows Q4 FY23 report.

- AUM: Assets Under Management / ETF: Exchange Traded Funds / FoF: Fund of Funds / NFO: New Fund Offering

- Data is as of March 31, 2023

- Figures are in Indian rupees (INR crores).

- Data is of domestic open-end funds and ETFs.

- A domestic fund is one that is domiciled in India and invests primarily in Indian markets. In this report,

we have included the asset flows of funds and ETFs with an allocation to Indian stocks and bonds as of

March 2023.

- This report provides insights into estimated flows, asset trends, and performance for domestic funds focused on the Indian equity and debt market. The flows are estimated from assets and total returns for the quarter ended March 2023. Morningstar calculates estimated net cash flows for global open-end funds and exchange-traded funds, an estimate of the money put in or withdrawn by fund investors, accounting for reinvestment of distributions.

- The disclosure of daily net assets is at the discretion of the fund provider.

AMCs with highest inflows and outflows